Philippine gov’t outstanding debt to breach P10-T in 2020, P12-T in 2021

The national government’s running debt balance is expected to balloon further this year and next year, budget documents showed.

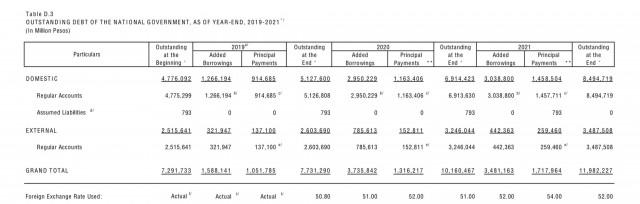

Budget and Expenditures and Sources of Financing for the fiscal year 2021 showed the government projects that the total outstanding debt for 2020 will amount to P10.16 trillion while for 2021 it is seen to reach P11.982 trillion.

The projected debt stock for 2020 is 31.42 percent higher than the P7.73-trillion outstanding government debt at the end of 2019.

For 2021, the state’s running debt stock is seen to increase by 17.93 percent.

The bulk of the projected P10.16-trillion debt for this year will be sourced locally at P6.91 trillion, while the remaining P3.246 trillion will come from external sources.

Meanwhile, for 2021, the government will borrow P8.5 trillion domestically and P3.5 trillion externally.

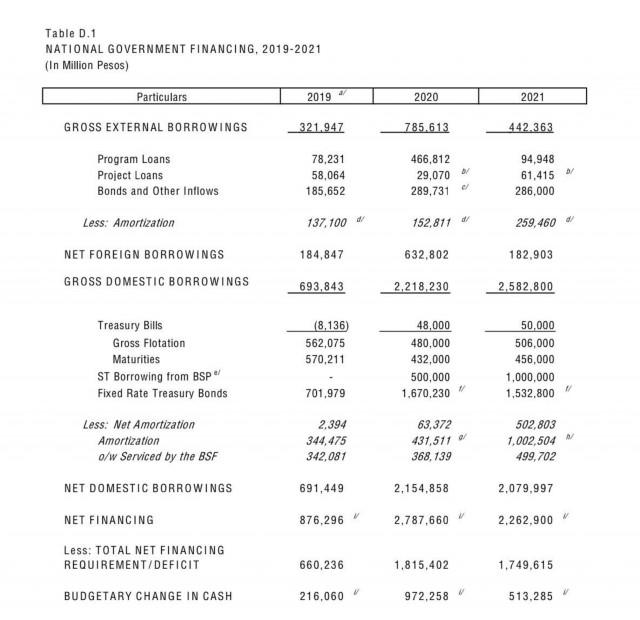

For this year alone, gross borrowings will reach P3.003 trillion, the lion’s share of which or P2.218 trillion will be sourced locally while the balance P785.6 billion will be from foreign sources.

Of the P2.218-trillion gross borrowings this year, bulk or P1.67 trillion will be raised through the issuance of fixed-rate treasury bonds.

Meanwhile, of the gross P785.61-billion external loans, P466.81 billion will be sourced from project loans, P29.07 billion from project loans, and P289.73 billion from bonds and other inflows.

To recall, the government announced it is ramping up its reliance on lending to fund the costly COVID-19 response and economic relief initiatives.

Lending efforts will be ramped up as the budget deficit for 2020 is seen rising to P1.815 trillion from last year’s fiscal gap of P660.2 trillion amid higher projected government spending of P4.335 trillion against lower expected revenues of P2.519 trillion.

With this, the Cabinet-level Development Budget Coordination Committee projects that the country’s debt-to-gross domestic product (GDP) ratio will spike by above 50 percent from a record low of 39.6 percent in 2019.

Finance Secretary Carlos Dominguez III said that the Philippines will sustain its P3-trillion borrowing program in 2021.

For next year, gross borrowings are expected to reach P3.025 trillion, 85 percent or P2.58 trillion of which will be sourced locally while the remaining 15 percent or P442.36 billion will be from foreign sources.

In his budget message, President Rodrigo Duterte said the higher financing requirements in 2021 will raise the debt-to-GDP ratio to 53.9 percent.

However, Duterte said the country’s debt-to-GDP ratio will remain lowest among the ASEAN member countries.

“This credit-worthiness and track record in economic management will also make borrowings less expensive for us,” the President said.

Likewise, the DBCC earlier said the national government’s debt will be kept at a “sustainable and responsible level” or within the 60 percent internationally-recommended debt threshold.

The World Bank said that a debt level equivalent to half of the size of the economy is still a safe or manageable level for the Philippines as the government intends to increase the debt level to augment funds for COVID-19 response and recovery efforts.

As of end-June 2020, the national government’s running debt stock reached P9.054 trillion, rising 15.1 percent year-on-year as the state ramped up borrowing to support COVID-19 response and recovery efforts. — DVM, GMA News