‘Tis the season of giving, but with every gift item purchased, investment deal secured, or travel promo confirmed is one fine opportunity for scammers to do what they do best: scam.

There is nothing new about these deceptive schemes. The digitalization of virtually everything, from transportation to food delivery to gambling and casinos, has been instrumental to fraudsters’ highly tedious but profoundly intentional techniques in looting and deception.

The scale and sophistication of these practices have improved vastly over the years, and the ordinary Filipino, with all his 11 hours a day of average social media exposure, is a prime target.

RECENT SCAMS

On December 14, 2023, the Securities and Exchange Commission (SEC) announced it has issued a cease and desist order against a company that offered sham investments and conducted fraudulent transactions via their sale of wellness products and skin care items, among the company’s other tricky packages.

This came just two months after Sparkle couple Paul Salas and Mikee Quintos filed charges in October against a cryptocurrency firm, allegedly a crypto-investment syndicate that reportedly took an estimated total of P8 million from the Kapuso artists and seven other victims.

There is a common denominator between the aforementioned cases: while both were found to be SEC-registered, they lacked the necessary licenses in order to sell and offer securities to the public. All their investment schemes and engagements, therefore, are unlawful to begin with.

But the common folk are probably not aware of that.

HOW TO SPOT YOU’RE GETTING SCAMMED

The rule of thumb has always been that if it’s too good to be true, it probably is. Be wary of a promised paradise with crazy good benefits and endless returns.

If the investment’s incentives, for example, are too enticing, take a step back and do some research about the company and its owner’s background. SEC Enforcement and Investor Protection Department Secretary Oliver Leonardo suggests that one should check with their agency if the company is duly registered not just as a corporate entity per se, but as one that’s licensed to sell and offer any form of product.

“Tingnan natin ‘yung financial performance, yung nagpapatakbo nito, ang management,” Leonardo said in a separate interview with GMA News.

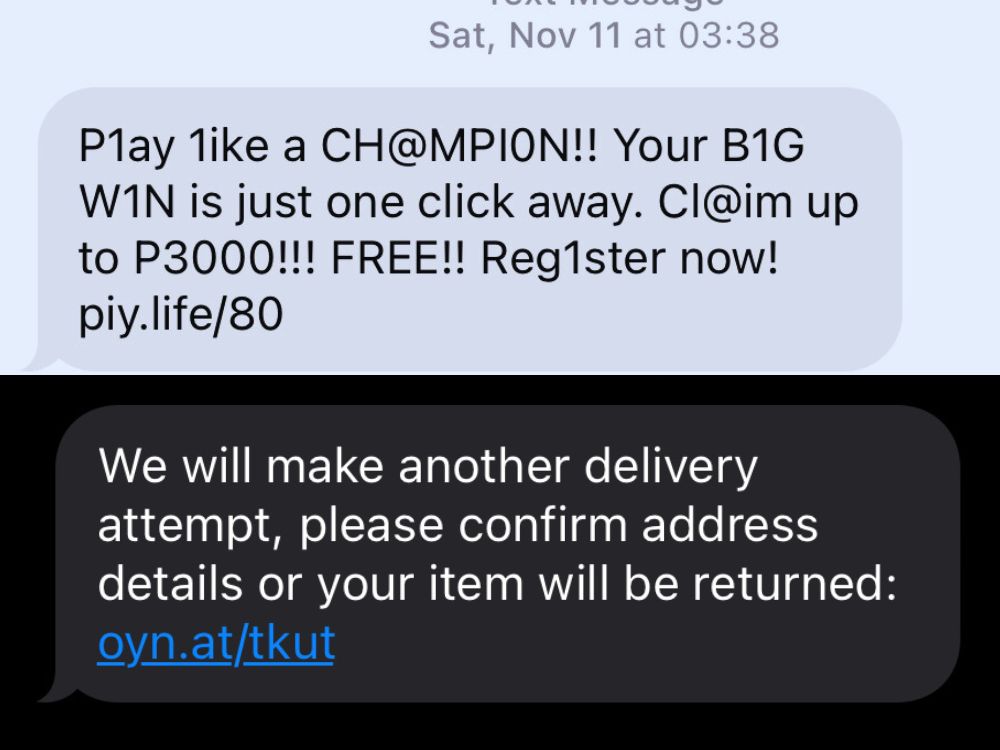

Likewise, text messages and email blasts that contain an unbelievable set of benefits and are only ‘waiting for your confirmation’ should be an automatic red flag. Swindlers would also always put a disguised URL right after the initial text spiel, which the public should never click, according to tech expert Art Samaniego told GMA News.

Some intuitive questions to ask oneself when assessing these messages: am I familiar with the company making the offer? Did I ever have any engagement with what’s being offered? Did I request or inquire about any form of product recently?

These questions can guide and help users avoid accepting impulsively promos that turn out to be phishing sites constructed particularly to extract personal information.

Another sign to look out for is when there is a heightened sense of urgency - messages that contain statements like ‘you got hacked!’, ‘recover your account now,’ or ‘your parcel cannot be delivered,’ especially when they are from random mobile numbers, which according to the National Telecommunication Commission (NTC) have been using personalized text messages and unwarranted requests that contain users’ personal information.

These schemes operate under the same fraudulent mechanisms as those that promise incentives and prizes. They appeal to the users’ emotions by triggering an immediate response either to an emergency or a moment of victory.

According to experts, there are other simple but effective ways to determine a scam: check the message for misspelled words and unusual grammatical errors; verify the company’s legitimacy by cross-checking their presence from other social media platforms; seek for comments and reviews that vouch for the shop’s legitimacy.

This increased propensity of Filipinos being scammed can be attributed to an interwoven set of cultural tendencies and external factors. The Philippines has consistently been named to the most active social media users list - which means a lot of screen time, and a ton more business transactions done online.

During the holidays, it is paramount to stay vigilant and be aware at all times. Spending a few more minutes in order to verify a shop’s account won’t ruin the day. The extra effort to look for sketchy parts of a message goes a long way. Scammers will have a hard time scamming if people are more aware of the simple do’s and don'ts of digital transactions.