Crowdfunding: A new way of investing in agribusiness

For busy professionals who do not have the luxury of time to put their money in the stock market, an alternative is to invest in agribusiness via crowdfunding.

Crowdfunding is raising capital for a project or a startup from a large number of people or a crowd, often via the internet.

There are crowdfunding platforms a “risk-taking” investor can try, like FarmOn.ph and Cropital.

Both platforms pool investment money to fund local farmers for a share of the profit after the produce has been sold.

Personal finance expert Randell Tiongson said crowdfunding is for risk takers, because it has “higher risks” than other investment platforms such as the stock market.

“It’s worth the try if you believe in the business and you have faith in the people behind it,” Tiongson noted.

FarmOn

FarmOn is a crowdfunding community helping farmers meet their financial needs and reap the rewards for their contribution.

Investors must register and open an account with FarmOn and place at least P1,500 to P5,000. The returns supposedly come after three to 12 months, depending on the crop.

“In every cycle, FarmOn will open a new project, crowd funders will then choose a specific product from the list which FarmOn will be posting. With the aid of the given contribution, our farmers can start the production,” it said.

“Members who have given their contribution for that project will receive reward only if the project has been deemed successful,” FarmOn noted.

However, crowd funders must acknowledge the risks involved in farming such as climate change and natural disasters.

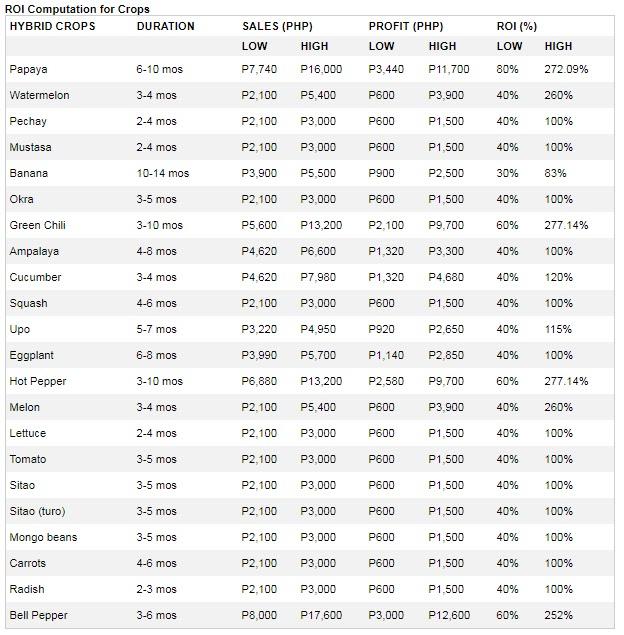

Below is a guide on return on investment from FarmOn:

Cropital

Like FarmOn, Cropital is a crowdfunding platform which supports farmers.

This is a social enterprise helping farmers gain access to scalable and sustainable financing, according to its website.

Investors also need to register and open an account with Cropital. The minimum investment is P5,000 to a maximum of P50,000.

An investor can select from local farms and expect returns on a per cycle basis. Returns are expected in three to six months at an average of 3.5 percent to 50 percent depending on the terms.

“For profit sharing, return on investment (ROI) is a fixed percentage of the net profit of the farm invested. This is dependent on the terms agreed upon by the farm community, considering the level of risks involved. Profit share is explicitly shown on the profile of the farm,” Cropital noted.

“It is important to note that majority of the profit goes to the farmers,” it said.

If sales did not meet the capital and the farmer did not have enough money to cover the crowd-sourced fund due to unavoidable circumstances such as low market price and weather-related events, Cropital will provide the farmer with another series of funding for the next crop cycle to recover the amount lost from the previous cycle.

“The funder will receive the repayment once the amount has been fully recovered by the farmer,” it said.

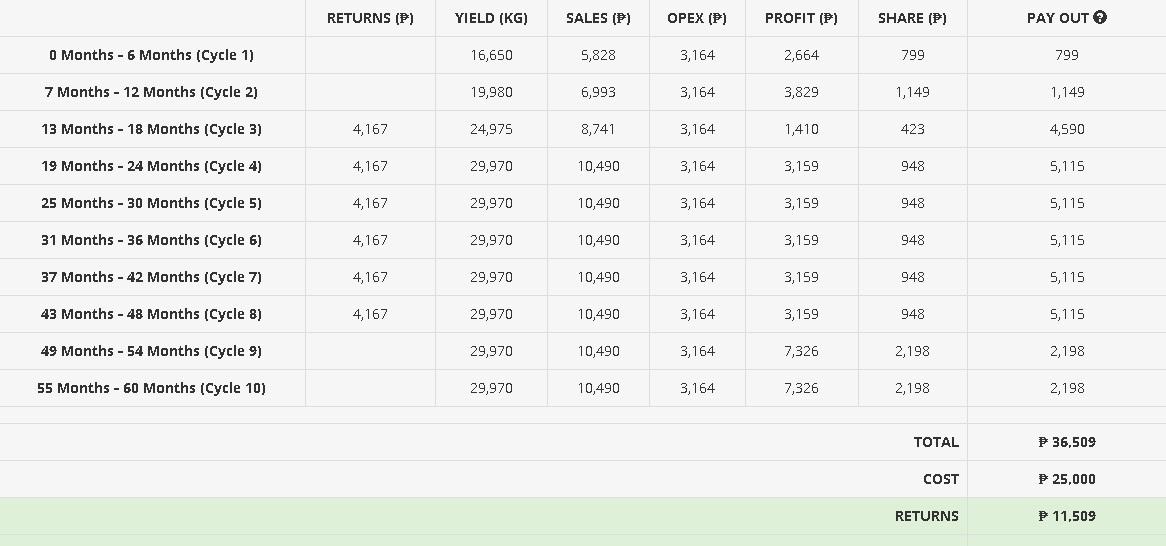

Here is a sample of the returns you can expect from Cropital:

Because of the risks involved in crowdfunding, Tiongson said guarantees are not always met.

“It’s the nature of that business. There cannot be any guarantees because you won't know how well the business goes,” he said.

“Expectations need to be clear. This is a high-risk investment, higher than even the risks in the stock market,” he added. —VDS, GMA News