Pass Rice Tariffication before TRAIN2

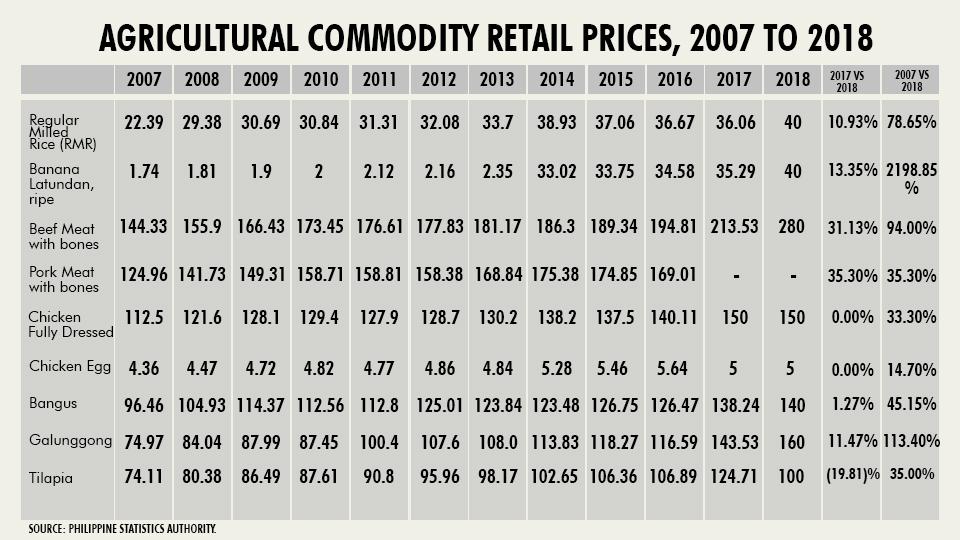

Tax reform has undoubtedly coincided with a period of higher inflation risk in the country. Any man or woman on the street can tell you that the slow creep of inflation in food, transport, among other necessities—particularly in urban areas—has debilitated the working man or woman’s take home pay. The rise in food prices is illustrative (see Table 1).

Galunggong prices have increased by around 12% in the past 6 months alone, while the price of beef increased by 13% during this same period. Yet, no other food is more central to Filipinos’ diets than rice – and it now poses a greater burden on poor and near-poor Filipinos’ budgets. Rice prices have increased by 11% during this same short period. And over the period from 2007 to the present, rice prices have increased by an astounding 80%.

embed

Data from the 2015 Family Income and Expenditure Survey (FIES) suggests that for the poorest 20% of Filipino households, rice expenditure alone accounts for more than 19% of their total budgets. (For the richest 20% of Filipino households, rice accounts for only 5% of their budget.)

The Duterte administration is confronted by an opportunity to address inflation—particularly food price inflation—by shifting away from quantitative restrictions on rice imports to a system based on moderate rice tariffs. A rice tariffication bill to revise RA 8178 (the Agricultural Tariffication Act) is currently being deliberated by both Houses of Congress. The idea is to impose a 35% tariff for rice imports from ASEAN countries, while non-ASEAN countries would be obliged at a 40% tariff rate. Believe it or not, even these high tariffs will actually allow for more rice to enter the Philippine market. The quantitative restrictions presently in place—which are now illegal under the WTO since we have exhausted our requests for extensions—has the tariff equivalent of roughly 67%.

We should support Secretaries Evasco, Pernia and Dominguez on their push for rice tariffication, not just to boost our agricultural sector but also to help fix the urgent challenge of food inflation. Tariffication and rice policy reform is probably more important than TRAIN, because this time the biggest winners are poor households and low-income workers. Tariffying rice under a moderate tariff will provide a win-win-win for the poor, consumers and workers, and farmers. Here’s why.

Why the poor win

The Philippines is experiencing among the highest inflation rates in 5 years, as of April 2018. One effective way to counteract this is to trigger a reduction in rice prices which in turn will increase the purchasing power of households, particularly those belonging to the poor and low-income group.

A study by Mapa, Castillo, and Francisco (2015) indicates that the change in rice prices at the current quarter likely affects reported hunger incidence in the immediate next quarter. If we apply this to the impact of tariffication on rice prices, preliminary estimates imply that a 17.5% decrease in retail prices could lead to as much as 38% reduction in the share of households reporting involuntary hunger—translating to around 1.35 million families lifted out of hunger.

Similarly, Cororaton and Yu (2016) estimated that a rice tariffication scheme that designates tariff revenues to cash transfers for the poor would result in a reduction of poor people by 4 million individuals over a ten-year period. This could nearly wipe out poverty in the country within a decade, and help implement President Duterte’s ambitious Ambisyon2040 long term vision of development.

How consumers and the working class wins

The government’s Family Income and Expenditure Survey (FIES) data from 2012 shows that an average household spent 23% of their total food expenditure on rice, while the bottom 60% allocated around 24% or higher. This affirms that a majority of Filipino consumers will directly gain if rice prices are reduced through tariffication.

Additionally, a 2013 study by the Southeast Asian Regional Center for Graduate Study and Research in Agriculture (SEARCA) by the Southeast Asian Regional Center for Graduate Study and Research in Agriculture (SEARCA) estimates the amount of additional income households from different income groups will sustain. Based on two assumptions i.e., that the retail price of rice will decline by Php 6.97/kg on average from present levels and that adjustments on rice consumption will be small, an average increase of Php 3,928 in disposable income is projected for household income groups D and E (equivalent to 23.5% of their annual rice expenditure). Likewise, those from the ABC income groups will have an additional Php 4,120 to spend (21.6%) on average. In short, this reform is decidedly pro-poor—unlike TRAIN1, which primarily benefited the middle class. If we manage to lower food inflation, then we will also improve the real wages of workers without requiring any wage increases. Clearly this would be good for industry as well, to the extent that upward wage pressure could be mitigated, and wages will remain competitive.

Farmers also win

Contrary to the view that only rice self-sufficiency (e.g. not importing rice) will benefit farmers, tariffication actually opens the door for a more pragmatic and more effective strategy to boost the agricultural sector. First, tariffication allows for a soft landing for the rice sector in at least two ways. Preliminary estimates from NEDA indicate that due to maintaining tariffs, the price of domestically-produced rice may still gain a price advantage of at least Php 4/kg against ASEAN-based imports.

Second, even as rice farmers may face stiffer competition (and domestic rice output may yet contract), the tariff revenues can still be directed towards providing more robust support to the agricultural sector in general, and rice farmers in particular. As estimated by the Philippine Institute for Development Studies (PIDS), an applied 35% of rice tariffs will accumulate at least Php 27 billion in revenues annually from the year of implementation, and more than Php 28 billion seven years following implementation.

Rice farmers may retort here that they have seen this before – that funds have been directed at the sector in the past, with very little results to show primarily because of leakages in the government agencies involved. This is a critically important opportunity to deploy funding for safety nets and rice productivity enhancement under a more participatory framework. The proposed amendments on the rice tariffication act includes the creation of the Rice Competitiveness Enhancement Fund (RCEF), a specialized institution to where the incremental revenues collected from the tariffication will be allocated.

This fund will be focused on aiding programs to improve the competitiveness of our local rice producers, as well as the provision of safety nets for disrupted livelihoods. Moreover, based on estimates by Briones and Tolin (2015), the cost of implementing robust safety nets for rice producers amounts to Php 17-18 billion annually. This means that around 63%-64% or one-third of annual revenues from the rice tariffs may be dispensed for productivity-related programs.

Governance is key

Given the Philippines’ mixed record in implementing agricultural sector support initiatives, and the goal to maximize our rice farmers’ engagement and ownership of these programs, it is time to advance long overdue innovations in the management of such special funds. This is the time to capitalize on lessons from experiences with participatory budgeting approaches, to ensure that famers’ associations and relevant civil society organizations identify, plan, budget, implement, monitor, and evaluate programs resourced by this fund.

These participatory mechanisms allow ensuring that safety nets and investments on productivity become more accessible to smallholders and are demand-driven in orientation. Through these productivity investments in farmers’ livelihoods, alongside offering them protection measures for transition, such well-implemented participatory programs could deliver net benefits even among rice farmers.

In the final analysis, our rice policy has failed not because of our farmers’ lack of effort—it is a failure so far because of poorly informed policy (e.g. rice self-sufficiency has never worked despite trillions shouldered by taxpayers and consumers) and poor governance (e.g. corruption in rice procurement is legendary). Poor households, the working class, and our farmers stand to gain from a more pragmatic food security policy that allows the agricultural sector to diversify.

*Ron Mendoza is Dean and Associate Professor of Economics at the Ateneo School of Government (ASOG) and Roehlano Briones is a Research Fellow at the Philippine Institute for Development Studies (PIDS). The authors thank Jerik Cruz and Ayn Torres of the Ateneo Policy Center for the research assistance. The views expressed are those of the authors and do not necessarily reflect the views and policies of the Ateneo de Manila University and PIDS. The interested reader may wish to consult the ASOG study on the topic that can be downloaded here.