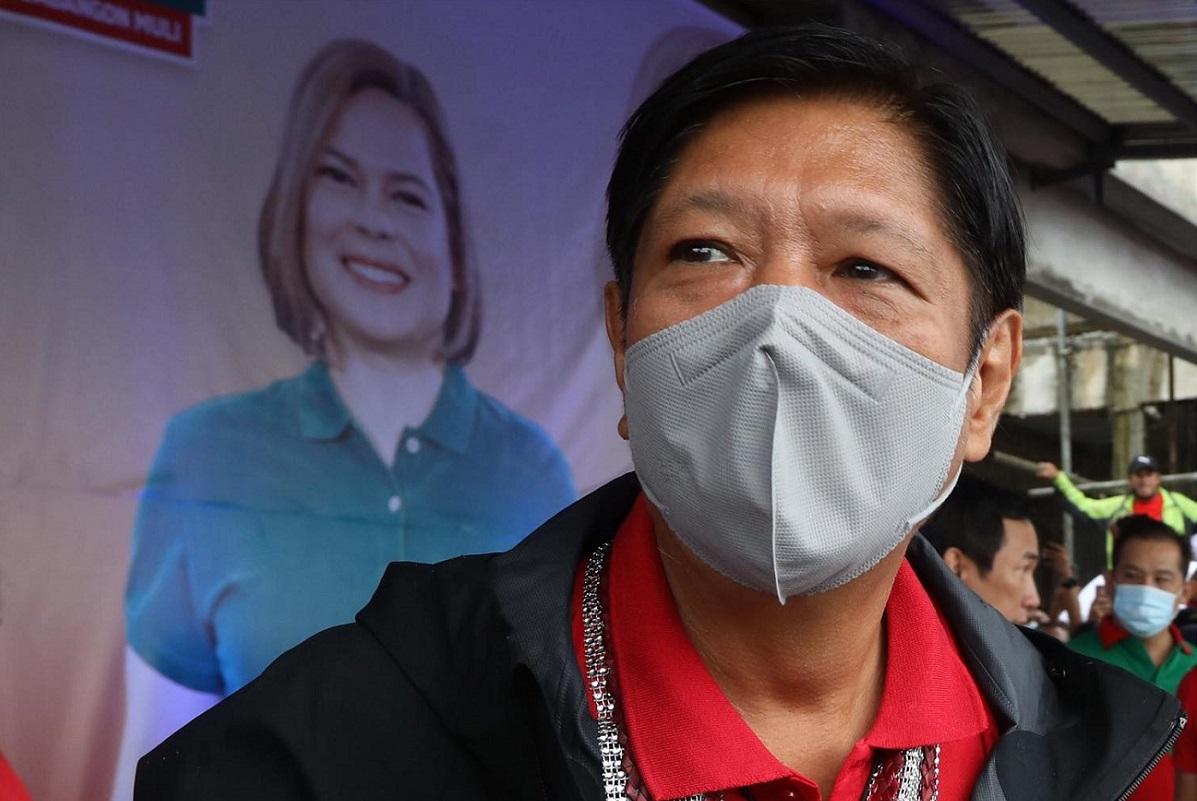

Ibinasura ng Commission on Elections First Division nitong Miyerkules ang huling Eleksyon 2022 disqualification case laban kay presidential candidate Ferdinand “Bongbong” Marcos Jr. dahil sa "kawalan ng merito."

Sa desisyon na pirmado nina Comelec Commissioners Socorro Inting, Aimee Ferolino, at Aimee Torrefranca-Neri, ibinasura ang inihaing petisyon ng Pudno Nga Ilokano (Ang Totoong Ilokano) laban kay Marcos.

“Wherefore, premises considered, the instant petition, is hereby denied for lack of merit,” saad sa resolusyon.

Ang petisyon ay may kaugnayan sa tax-related cases noong 1995 kung saan nahatulang nagkasala si Marcos.

Sa petisyon ng grupo, sinabi nilang walong beses na na-convict si Marcos Jr. ng Quezon City Regional Trial Court (QC RTC) Branch 105 noong 1995 dahil sa kabiguan na mag-file ng kaniyang income tax returns bilang gobernador ng Ilocos Norte para sa taong 1982 hanggang 1985. Bigo rin umano si Marcos na magbayad ng deficiency taxes.

Sa pasya ng Court of Appeals noong 1997, binago nito ang parusa at inatasan si Marcos Jr. na magbayad ng tax deficiencies at magmulta.

Ayon sa Comelec division, ang non-filing of income tax returns ay hindi krimen na kinasangkutan ng "moral turpitude," na basehan para madiskuwalipika ang isang kandidato.

"If failure to file income tax return is considered alone, it would appear that it is not inherently wrong. This is supported by the fact that the filing of income tax return is only an obligation created by law and the omission to do so is only considered as wrong because the law penalizes it," ayon sa resolusyon.

Binigyan-diin din na nagbayad umano si Marcos Jr. ng income tax liability "through the withholding system, albeit not in full."

"Even if his tax liability was not paid in full, the same was not done willfully by respondent (Marcos Jr.) since, as the CA explained, it is the government's obligation to withhold the income tax of respondent and the latter had the right to rely on the computation of the taxes withheld," paliwanag sa resolusyon.

"In the case of respondent, it can be said that the filing of income tax return is only for record purposes, not for the payment of tax liability. He may have been neglectful in performing his obligation, it however does not reflect moral depravity," dagdag nito.

Kahit hindi umano nakapagsumite si Marcos ng ITR ng ilang taon, “there is still no tax evasion to speak of as no tax was actually intentionally evaded. The government was not defrauded."

Ayon kay Comelec Commissioner George Garcia, tatalakayin sa en banc meeting ang desisyon kung babaligtarin o kakatigan ng mga opisyal ng Comelec.

Bukod dito, maaari ding dalhin ng mga naghain ng petisyon ang kanilang hinaing sa Korte Suprema.—FRJ, GMA News