Exposure to Hanjin Philippines may put local banks’ ratings under pressure —Fitch

Their exposure to what may well be the largest corporate default in Philippine banking history may put pressure on the credit ratings of local lenders, Fitch Ratings said Wednesday.

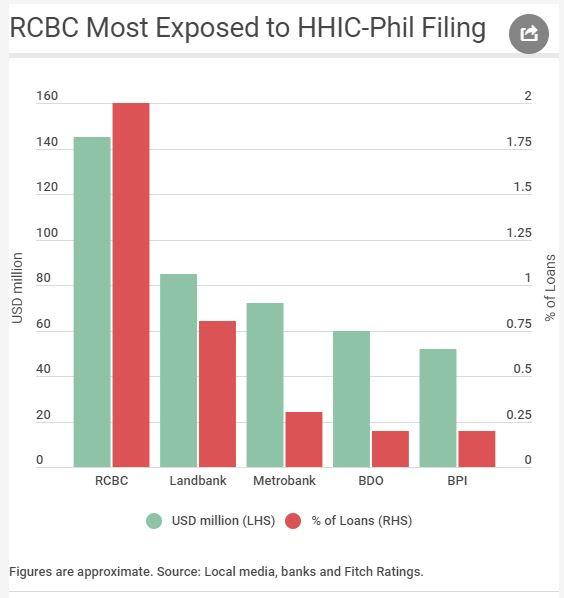

Five local lenders could incur a dent on their ratings due to their combined exposure of $412 million to bankrupt shipbuilder Hanjin Heavy Industries and Construction Company Philippines (HHIC-Phil), according to Fitch.

“Local banks’ loans to HHIC-Phil are equivalent to only around 0.2 percent of system loans, but some banks have more significant exposure, which could put pressure on their ratings.”

The banks include BDO Unibank Inc. (BDO), Bank of the Philippine Islands (BPI), Land Bank of the Philippines (LandBank), Metropolitan Bank & Trust Co. (Metrobank), and Rizal Commercial Banking Corp. (RCBC).

“The problems at HHIC-Phil, the country’s largest shipbuilder, stem from the extended weakness in the global shipping industry and financial issues at its Korean parent company, Hanjin Heavy Industries & Construction, which has been undergoing corporate restructuring since 2016,” said Fitch.

“The sector- and company-specific causes suggest this case is unlikely to indicate broader stress across banks’ loan books, even if we expect some knock-on effects for HHIC-Phil’s employees and local service industries,” it added.

“Rizal Commercial Banking Corp. (RCBC) reportedly has the largest exposure of around $145 million, equivalent to 2.0 percent of its gross loans,” Fitch noted.

“The full amount exceeds its 2017 net profit, and provisioning on these loans could result in the bank reporting at least one quarterly loss, implying some risk of capital impairment, although we do not expect the bank to set aside the full amount of its exposure,” it added.

RCBC has dismissed the severity of the situation, saying the amount of its exposure to Hanjin Philippines is manageable.

“The amount involved is very manageable and the borrowing company’s business is actually very attractive with a lot of potential,” the bank said.

“With the five creditor-banks working together and looking for an investor as one option, the matter’s resolution is just a matter of time and we expect that to be sooner than later,” it added.

In a separate statement on Wednesday, the Yuchengco-led RCBC maintained it is in a strong position to absorb the exposure in Hanjin Philippines.

“The bank’s balance sheet, with a capital of P84 billion as of September 2018, is in a strong position to absorb these provisions,” the bank noted.

However, we do not expect the bank to provide for the full provision. Even with the default, the Bank’s capital adequacy ratio of 17.3 percent as of Sept 2018 remains very strong and well above the regulatory minimum and can still support medium-term loan growth,” it added.

As of September 30, 2018, RCBC was the 10th largest bank in the Philippines in terms of assets at P500.845 million.

Fitch cited the exposure of BPI, BDO, and Metrobank, noting their risks are manageable.

“The exposure of the three largest banks—BPI, BDO and Metrobank—is more manageable relative to their loan books and pre-provision profits,” said Fitch.

The Bangko Sentral ng Pilipinas said the exposure of local banks is “very negligible” based on preliminary analysis.

“Based on our initial assessment, some banks are exposed to Hanjin. But relative to both total loans of the banking system and total FCDU loans of the banking system, their exposure is very negligible,” said Bangko Sentral Deputy Governor Diwa Guinigundo.

“Our banks as a whole are very strong and more than adequately capitalized, their assets continue to grow and the quality of their loans based on nonperforming loan ratio is less than 2 percent,” he added.

At the close of trading Wednesday on the Philippine Stock Exchange, RCBC shares were down P0.45 or 1.66 percent at P26.70 per share from P27.15 on Tuesday. BDO Unibank dropped P1.40 or 1.07 percent to P129.50 from P130.90.

BPI gained P0.70 or 0.75 percent to P94.50 from P93.80, while Metrobank rose by P1.00 or 1.25 percent to P81.00 from P80.00. —VDS, GMA News