SEC revokes corporate registrations of Discaya-owned St. Timothy, St. Gerrard

The Securities and Exchange Commission (SEC) on Thursday announced the revocation of the corporate registrations of two construction firms owned by the contractor couple Sarah and Curlee Discaya —key figures in the ongoing flood control corruption scandal.

In a statement, the SEC said that its SEC Enforcement and Investor Protection Department (EIPD), in separate resolutions issued on November 26, canceled the certificates of incorporation of St. Timothy Construction Corporation and St. Gerrard Construction General Contractor and Development Corporation for “submitting false beneficial ownership information.”

Moreover, Discaya-led St. Timothy and St. Gerrard were ordered to pay P2 million each as a penalty, in accordance with Section 11, I-A of SEC Memorandum Circular (MC) No. 10, Series of 2022, plus an administrative fine of P1,000 per day of continuing violation, pursuant to Section 158 of Republic Act No. 11232, or the Revised Corporation Code.

The corporate regulator further disqualified the directors of both St. Timothy and St. Gerrard from being a director, trustee, or officer of any corporation for a period of five years for failure to ensure the accuracy of the beneficial ownership declaration.

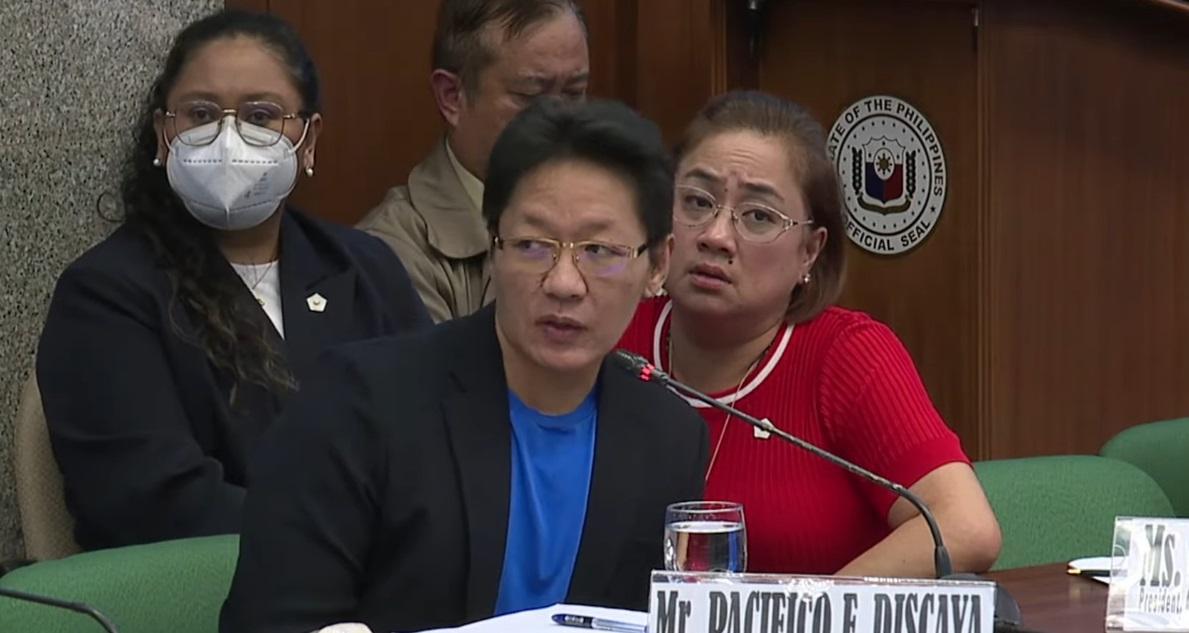

In revoking the corporate registrations of the Discaya-led firms, the SEC cited Cezarah Rowena “Sarah” Cruz-Discaya’s statements during a Senate Blue Ribbon Committee hearing on September 1, 2025 in which she said that she was the owner and officer of St. Timothy and St. Gerrard.

However, the EIPD, which looked into the SEC’s records, found that Cruz-Discaya was not disclosed in the beneficial ownership declarations of St. Timothy from 2022 to September 2025, and of St. Gerrard from 2022 to 2024.

“The failure of St. Timothy and St. Gerrard to disclose Cruz-Discaya as their beneficial owner constituted a violation of SEC MC No. 15, Series of 2019, as amended by MC No. 10, Series of 2022, which required companies to submit their beneficial ownership information as part of their general information sheets,” the corporate regulator said.

“As early as September, the SEC issued separate notices to the two companies, directing them to pay a P2 million fine each for the false declaration of beneficial ownership information,” it said.

The SEC bared that both companies were given 15 calendar days upon receipt of the notice to explain or justify their violations, “but neither complied within the prescribed time.”

The commission stressed that corporations must accurately and truthfully disclose beneficial ownership information as “failure to comply—whether by omission or by submission of incorrect information—undermines market integrity and will be met with decisive regulatory sanctions.”

The corporate regulator, moreover, said that corporations are expected to respond promptly and responsibly when allowed to clarify or rectify discrepancies in their filings.

The SEC clarified that the administrative sanctions imposed against the Discaya-led firms “are separate from, and do not preclude, any other proceedings or measures that may arise under the Revised Corporation Code or other laws.”

“The revocation of the companies’ corporate registration does not prejudice the filing of other administrative, civil, or criminal actions that may be taken based on other violations of the RCC or other applicable laws, rules, and regulations,” it said.

“The SEC continues to remind all corporations of their duty to maintain accurate beneficial ownership information and to update their submissions promptly as required by established regulations,” it added. —RF, GMA Integrated News