Lower income tax rates to greet taxpayers next year — BIR

Individual taxpayers will be charged lower tax rates starting next year, the Bureau of Internal Revenue (BIR) said Friday.

Individuals earning purely compensation income, including non-business/non-profession related income and sole proprietors, "can look forward to a higher take-home pay in 2023," according to the BIR.

The taxman said the lower income tax rate is pursuant to Republic Act 10963, or the Tax Reform for Acceleration and Inclusion (TRAIN) Law, which took effect on January 1, 2018.

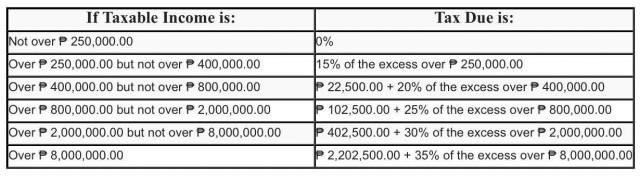

Starting January 1, 2023, those with annual taxable income below P250,000.00 are still exempt from paying personal income tax, while the rest of taxpayers, except those with taxable income of more than P8 million, will have lower tax rates ranging from 15% to 30% by 2023.

To maintain progressivity, the BIR imposed a 35% tax rate on top individual taxpayers with annual taxable incomes exceeding P8 million, up from 32% previously.

The income tax on the individual’s taxable income shall be computed based on the following schedules, effective January 1, 2023, and onwards:

Compared to the income tax rates imposed during the initial implementation of the TRAIN Law in 2018, the new annual income tax rates for individuals significantly decreased by 5% for those with taxable income of more than P250,000.00 up to P2,000,000.00, while a 2% decrease in tax rate was noted for those with taxable income of more than P2,000,000.00 up to P8,000,000.00.

"With the said reduction in the annual income tax rates, individuals earning purely compensation income will have lower withholding tax deductions from their monthly salary, thereby increasing their take-home pay," said BIR Commissioner Romeo Lumagui Jr.

Employers must use the revised withholding tax table to calculate withholding taxes on their employees' compensation income beginning January 1, 2023. —VBL, GMA Integrated News