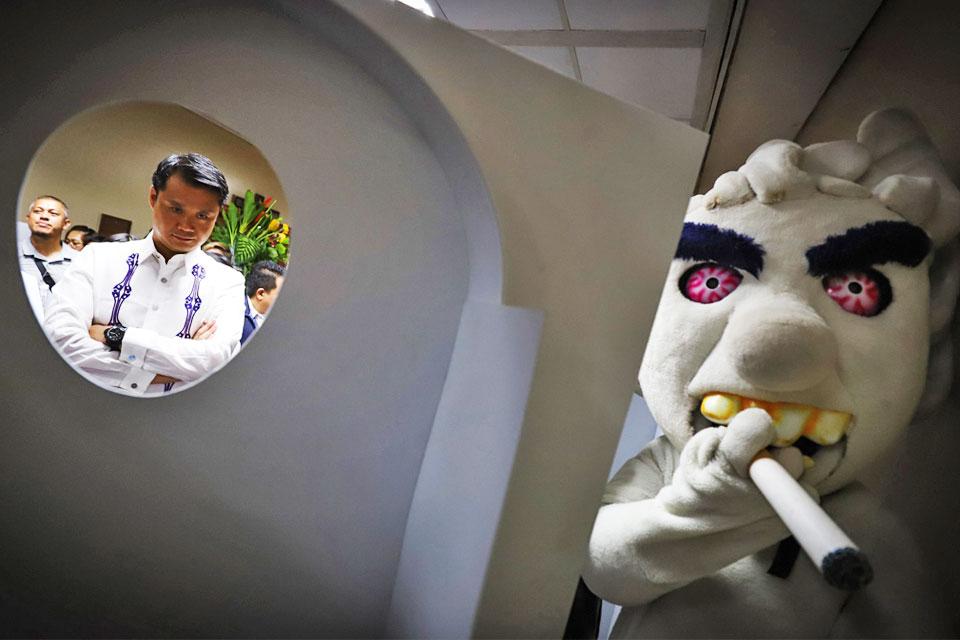

Gatchalian to block bill lowering excise taxes on tobacco

Senate ways and means committee chairperson Sherwin Gatchalian on Monday vowed to block a measure that will reduce excise tax on cigarettes, saying such cuts will not solve the country’s cigarette smuggling problem.

Gatchalian made the position during Monday's committee deliberations on House Bill 11360, which lowers the excise tax for cigarettes, tobacco, heated tobacco, and vapor (e-cigarette/vape).

“What we are after in the committee is to combat and eliminate illicit trade. Illicit trade creates a lot of problems in terms of revenue collection and health outcomes. Illicit trade is the devil. And in those last three hearings, we didn’t see that lowering taxes [on cigarettes] can combat illicit trade effectively," Gatchalian said.

“Habang ako ang chairman ng ways and means committee, hindi ko papayagan na maipasok iyang cigarette component in the bicameral conference committee. With all due respect to my counterparts, and I am putting this on record for our House counterparts...kung iyan ang i-iinsist nila, mag-usap na lang tayo 20th Congress because we will not allow that,” Gatchalian added.

Under the bill, the current excise tax rate of P66.15 per pack of cigarettes will be increased by 2% every even-numbered year effective on January 1, 2026 and 4% every odd-numbered year, effective January 1, 2027 until December 31, 2035.

These rates, however, are lower than those provided under the 2012 Sin Tax law, which imposed an excise tax rate of P60 per pack of cigarettes by 2023, an amount that increases by 5% every year starting January 1, 2024.

Instead of slashing taxes on cigarettes, Gatchalian said there is a need to pour in resources to beef up anti-smuggling teams of various government agencies.

“That is why we are open to funding the DTI (Department of Trade and Industry), BIR (Bureau of Internal Revenue), and the task force on illicit trade...from the BIR, it is a good suggestion that we fund it so that we will have a full-time composite team to combat illicit trade. That is our objective,” Gatchalian added.

Gatchalian said he will be amenable to the House Bill 11360 which provides for a unitary P66.15 per milliliter or a fraction thereof excise tax on any vapor product (e-cigarette) containing any liquid substance, regardless of nicotine content, provided that the measure will not include provisions on lowered taxes for cigarettes.

Under current laws, the excise tax imposed on vapor products only covers those with nicotine salt/salt nicotine and conventional ‘freebase’ or ‘classic’ nicotine, with differing rates.

“The difference [of excise tax rates] on freebase and [classic] nicotine vape products is creating problems and incentivizing technical smuggling in the country. And that is what we want to stop,” Gatchalian said.

“What we want now is a unitary system for vape products,” Gatchalian added.

Senator Pia Cayetano agreed with Gatchalian’s position.

"We should not repeat the mistakes of the Vape Law, which stripped away critical regulatory protections established under the Sin Tax Reform Act. We must not allow history to repeat itself," Cayetano said.

"Reducing taxes clearly does not address the health costs of these sin products, but even adds to them. It also undermines the government's ability to fund essential health services, including the Universal Health Care program, which heavily relies on sin tax revenues," Cayetano added.—LDF, GMA Integrated News