Is a P100-million cash withdrawal a suspicious transaction? It depends, says AMLC

Do banks report a cash withdrawal of P100 million made by a government contractor as a suspicious transaction to authorities?

Not necessarily, the Anti Money Laundering Council (AMLC) said Thursday.

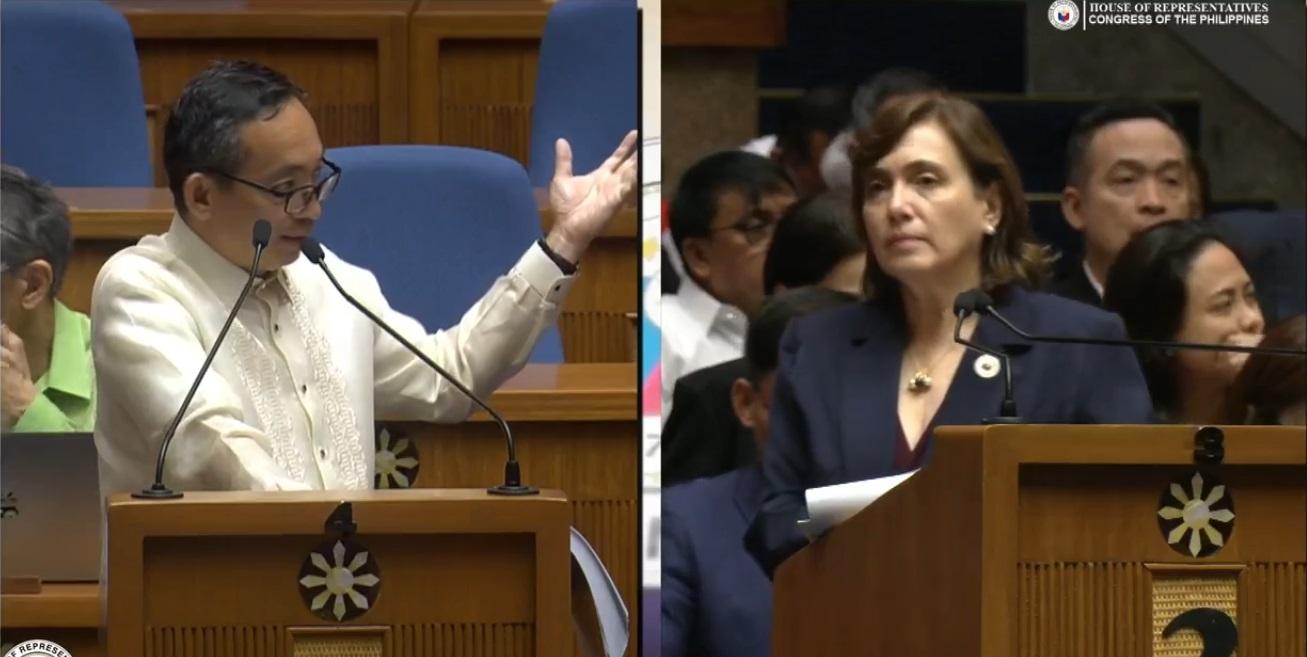

The AMLC, through its budget sponsor Negros Oriental Representative Ma. Isabel Sagarbarria, made such a reply when House Deputy Minority Leader and ACT Teachers party-list Representative Antonio Tinio cited the testimonies made before the congressional probe into the anomalous government flood control projects wherein Department of Public Works and Highways officials, contractors and other individuals confessed to withdrawing hundreds of millions of public funds from banks for payoffs and commissions.

“The contractor receives the cheque [for payment of their government contract], and in order for that check to become cash, the bank has to process that. But if we're talking about the amounts involved here as told before the inquiries, P474 million, P500 million P1 billion [withdrawn] in two days, are these not considered suspicious transactions? Even if you just withdraw P100 million in cash, would that be considered by AMLC as a suspicious transaction?” Tinio said.

Sagarbarria, speaking for AMLC, replied, “Unless there is a report [from the bank] that these are suspicious transactions...because it depends upon the banks since I believe, these contractors are big contractors, so that’s the usual amount that they probably transact [with the bank].”

Tinio then asked if this means that the AMLC does not find a cash withdrawal of P100 million, P200 million and P300 million in a day suspicious transactions, Sagarbarria clarified, “They [banks] have to report it to AMLC.”

Tinio then decried such a response from the AMLC, saying that being dependent on the banks’ judgment in identifying which transactions are suspicious makes the agency inutile and allows corruption to thrive.

“Based on AMLC’s explanation, AMLC is essentially powerless and fully dependent on the evaluation and self-reporting of banks when it comes to the handling of the withdrawal and transfers of huge sums of money. Legitimate businesses, normally, will transact by electronic transfers,” he said.

“Under the law it all depends on the evaluation of the bank. So if, for example, a contractor withdraws a large sum like P100 million pesos in one transaction, if the bank thinks that's part of their normal course of business, then no report will be made to the AMLC. Who does transact such a huge amount of money to begin with? Ang punto ko po, inutil ang AMLC sa kaso na ito. Sorry po kung masakit ang sinasabi ko. Pero hindi po napigilan ang mga ganito kalaking suspicious transactions [My point is, the AMLC is useless in this situation. I apologize if my words are harsh. But these suspicious transactions are not stopped],” he added.

Under the Anti-Money Laundering law, banks should report the following covered transactions to the AMLC:

- transaction in cash or other equivalent monetary instrument exceeding P500,000

- transaction with or involving jewelry dealers, dealers in precious metals and dealers in precious stones in cash or other equivalent monetary instrument exceeding P1 million

- a cash transaction with or involving real estate developers or brokers exceeding P7.5 million or its equivalent in any other currency.

Tinio also said it is so bewildering that while AMLC was dragging its feet on contractors and other individuals' withdrawing hundreds of millions of public funds in one go, AMLC acted so fast in freezing assets of non-government organizations Community Empowerment Resource Network (Cernet) (P35,000) and Rural Missionaries of the Philippines (P19 million) who were accused of supposedly financing the communist movement which the government identifies as terrorists.

“When it involves organizations like Cernet and Rural Missionaries of the Philippines who help the poor, indigenous peoples, farmers, fisher folk communities, AMLC acts promptly. But when it involves billions, hundreds of millions of public funds moving through the banking system from off government banks and other banks involving DPWH, contractors and politicians, AMLC cannot do anything unless the banks report it to them,” Tinio said.

Sagarbarria, in response, said that “the AMLC ensures compliance of covered persons, including the banks, with the Anti Money Laundering Law.”

In addition, Sagarbarria cited the previous actions of AMLC wherein the agency issued a freeze order covering 592 bank accounts of individuals and contractors linked to the irregularities in the flood control projects in the country.

Earlier, the AMLC also froze 135 bank accounts and 27 insurance policies of individuals and corporations following a request from the Department of Public Works and Highways (DPWH). — BM, GMA Integrated News