BIR files multiple tax complaints vs. Discaya couple

The Bureau of Internal Revenue (BIR) on Wednesday filed multiple tax complaints with the Department of Justice (DOJ) against contractors Pacifico "Curlee" and Sarah Discaya as well as a corporate officer over P7.1 billion in tax liabilities from 2018 to 2021.

BIR Commissioner Jun Lumagui said they filed separate tax evasion complaints for the couple, unlawful possession of excisable articles without payment of excise tax, and failure to file excise tax returns.

“Ito ‘yung mga personal liabilities na nakita natin sa kanila. Sila mismo ang kinasuhan natin ng tax evasion patungkol sa income tax supposedly na hindi nila nabayaran,” Lumagui said in an ambush interview.

(These are the personal liabilities we found in them. They themselves were charged with tax evasion regarding the income tax they supposedly failed to pay.)

“And also ‘yung sinabi rin nila na nag-divest sila sa apat na korporasyon. Nakita natin na hindi din bayad ang taxes sa pagkalipat ng mga shares na ito. At iyan ay may kaukulang kaso rin,” he added.

(And also what they said about divesting from four corporations. We saw that the taxes for the transfer of those shares were also not paid. And that too carries a corresponding case.)

He said the BIR also found that the excise taxes of their luxury vehicles were not paid.

Corporate officer

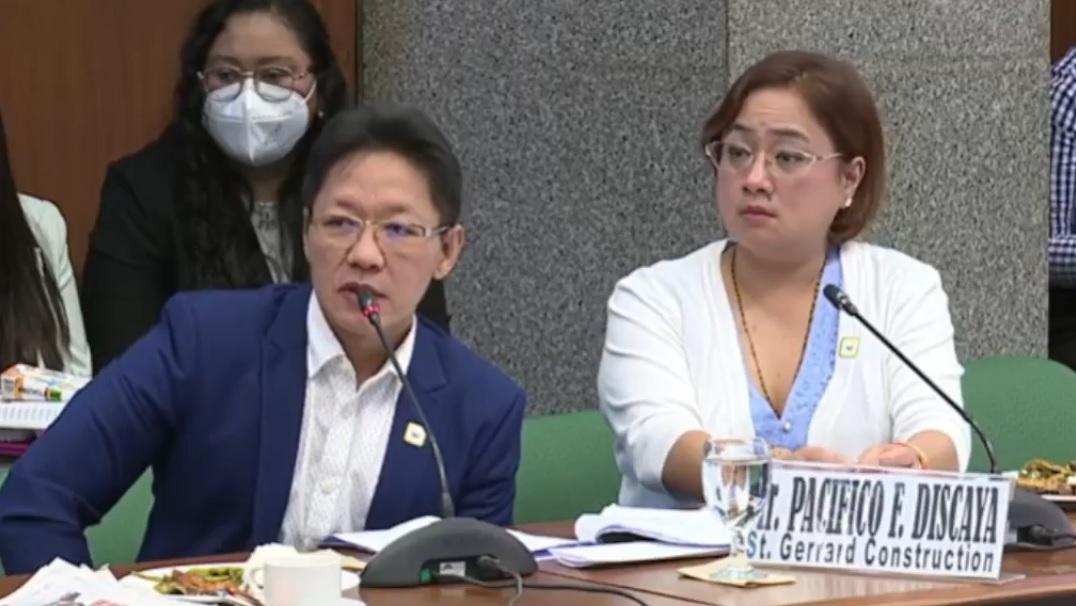

According to the BIR, another respondent is the corporate officer of St. Gerrard Construction Gen. Contractor and Development Corporation.

“‘Yung corporate officer na ‘yan siya ay may hawak na mga libro ng St. Gerrard. So lahat ng ginawa na tax evasion connected siya, kasama siya sa kaso,” he said.

(That corporate officer holds the books of St. Gerrard. So everything done related to tax evasion, he is connected and included in the case.)

Asked about the long period for the filing, Lumagui said the BIR is having a hard time as they are not that compliant.

“Unang-una binibigyan natin ng due process na ganyan. Minsan hindi nila tinatanggap ‘yung mga notices so kinakailangan pa natin mag resort sa iba’t ibang paraan para ma-serve ito. Also sumusulat tayo sa iba’t ibang ahensya ng gobyerno,” he said.

(First of all, we give them due process like that. Sometimes they don’t accept the notices, so we have to resort to different ways to serve them. We also write to various government agencies.)

Lumagui said that after their notices were ignored, the BIR issued a subpoena, which was also ignored.

Due to this, he said the BIR filed a criminal case against them.

“Kaya nagsampa rin tayo ng kasong kriminal kasi maituturing na criminal case ‘yan kapag hindi ka tumupad sa subpoena na inissue ng BIR,” he said.

(That’s why we also filed a criminal case because it can be considered a criminal offense if you fail to comply with the subpoena issued by the BIR.)

He said that the Discaya couple are mandated to pay the taxes.

Curlee Discaya is at the DOJ as of posting time for the ongoing investigation into anomalous flood control projects.

Cornelia Samaniego III, the legal counsel of the Discayas, declined to comment.

Lumagui said that the BIR’s audit for the other taxable years is ongoing and that more cases may be filed against the Discayas and other contractors. — RSJ, GMA Integrated News