Solon: Deduct unremitted benefits from delinquent firms’ tax refunds, gov’t funds

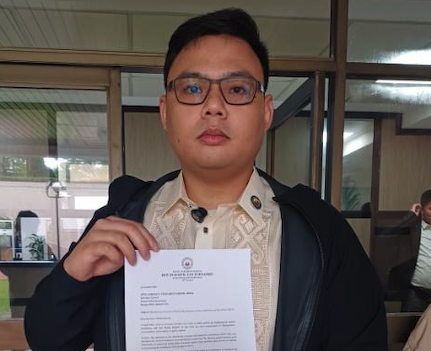

Unremitted benefits from delinquent state-run companies should be deducted from their tax refunds and funds that they receive from the government, Kamanggagawa Party-list Rep Eli San Fernando said on Monday.

“Ang di na remit na benepisyo ng mga delinquent companies ay dapat ibawas sa mga natatanggap nilang tax refund at funding mula sa government contracts,” San Fernando said during his privilege speech.

(The unremitted benefits of delinquent companies should be deducted from the tax refunds and funding they receive from government contracts.)

The lawmaker made the remarks as he lamented the alleged late payments of benefits by the Social Security System (SSS) to its members.

Citing data from the Commission on Audit (COA), San Fernando said the SSS has P209 million in late payments of benefits to its members, some of which are 18 years overdue.

He claimed that the SSS was the most complained-about government-owned or controlled corporation with 269 complaints based on a report of the Anti-Red Tape Authority (ARTA).

This was followed by the Government Service Insurance System (GSIS) with 134 complaints and the Pag-IBIG Fund with 37 complaints.

The lawmaker also pointed out that while beneficiaries are not paid, the increase in bonuses of SSS executives are not adequately justified.

“Recently, COA flagged P333 million of employee bonuses not backed up by sufficient justification,” he said.

GMA Integrated News has reached out to the SSS for comment on San Fernando’s privilege speech and will publish it once available.

San Fernando said he will file a resolution that seeks to review Republic Act 11199 or the Social Security Act of 2018.

“SSS should increase pension payouts and benefits, and not provide hefty bonuses to executives while it remains largely dysfunctional. Habaan pa natin ang unemployment insurance dahil madalas ay kulang ang dalawang buwan upang makapagsimula muli,” he said.

(SSS should increase pension payouts and benefits, instead of giving hefty bonuses to executives while it remains largely dysfunctional. We should also extend the unemployment insurance, as the usual two-month period is often insufficient to start anew.)

“Taasan ang monthly salary credit ceiling upang mapadali ang paghiram mula sa kontribusyon at maipataas ang pensyon na natatanggap. Isa-batas natin ang regular mandatory actuarial reviews,” he added.

(Raise the monthly salary credit ceiling to make it easier to borrow from contributions and to increase the pensions received. We should also institutionalize regular mandatory actuarial reviews.)

Earlier this month, state auditors flagged SSS for its purchase of 143,424 rolls of tissue paper worth P13.195 million in 2024 that showed indications of poor planning.

It also cited almost P3 million in underpayment of SSS funeral benefits, while some deceased pensioners still received their pension benefits from the SSS, resulting in an overpayment of P24.811 million.

The COA added that the SSS gave cash incentives of up to P50,000 each to its 6,525 officials and employees, totaling P333 million through the Prestige Award.

SSS has yet to issue a comment on the matter.

It also announced the release of over P18 billion to credit the annual cash gifts or 13th month pension of its nearly four million pensioners. — JMA, GMA Integrated News