Senate bill seeks to trim VAT from 12% to 10%

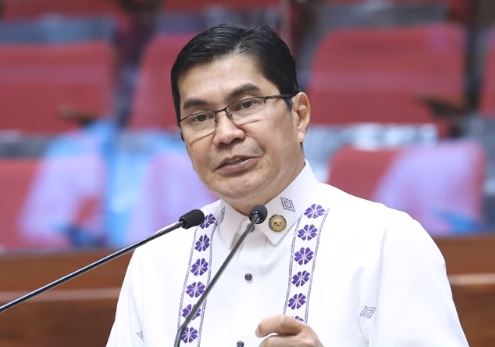

Senator Erwin Tulfo has filed a bill seeking to reduce the value-added tax (VAT) from 12% to 10% to help ease inflationary pressures on Filipinos’ cost of living.

Tulfo said his Senate Bill No. 1552, or the proposed “VAT Reduction Act of 2025,” aims to increase the purchasing power of households.

“A reduction in VAT is therefore consistent with the Constitution’s mandate to establish a progressive tax system that promotes equity and social justice,” the bill’s explanatory note read in part.

He said that by lowering the VAT, the government directly leaves more money in people’s pockets and encourages them to spend more, instead of government doleouts that that may be lost due to inefficiency or corruption.

This increased spending among consumers can help grow the economy, improve tax collection, and help make up for the government’s loss in revenue as the economy expands, he said.

Tulfo pointed out that the Philippines and Indonesia, both of which impose a 12% VAT, have the highest VAT rates in Southeast Asia, compared with the 7% to 10% rates in other neighboring countries.

“The VAT Reduction Bill will not only lighten the load for ordinary Filipinos but will also make our country more competitive among our Southeast Asian neighbors,” the senator said in a statement.

The bill includes a safeguard provision allowing the President to temporarily restore the 12% VAT rate upon the recommendation of the Secretary of Finance, if the Development Budget Coordination Committee projects that the national deficit will exceed its prescribed limits for the fiscal year.

Meanwhile, Cavite 4th District Rep. Elpidio “Kiko” Barzaga Jr. earlier filed a separate measure seeking to scrap the VAT entirely, reducing the rate from 12% to zero.—MCG, GMA Integrated News