3 excise tax complaints vs Discaya couple, others dismissed — DOJ

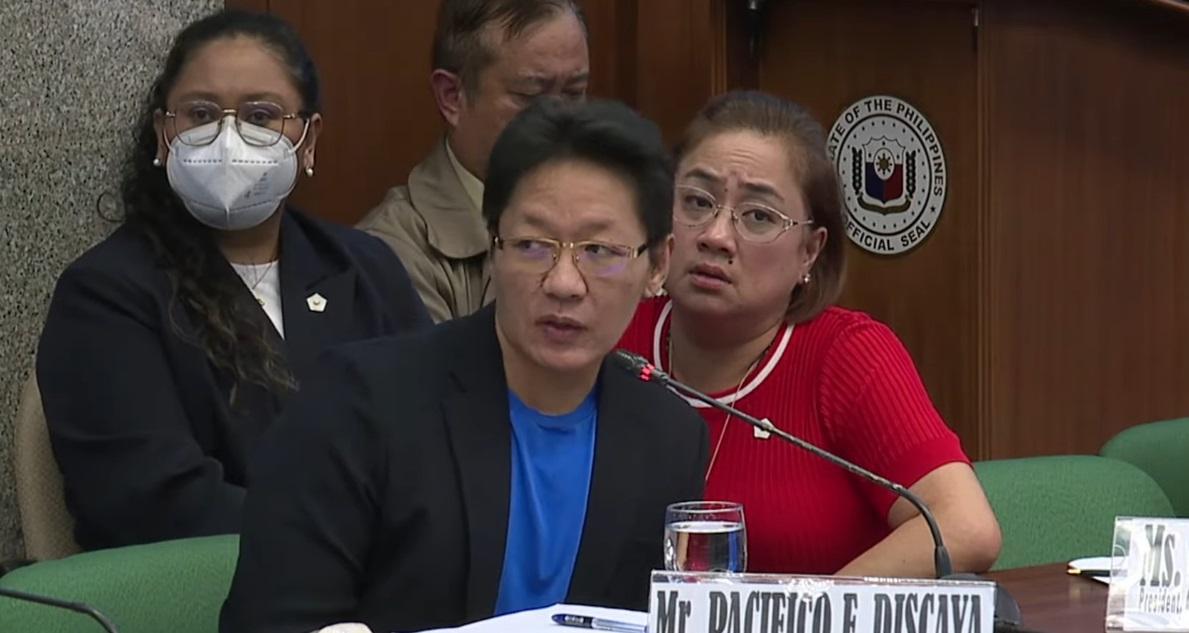

The Department of Justice (DOJ) dismissed three excise tax complaints filed against contractors Curlee and Sarah Discaya and others over several luxury vehicles, Justice spokesperson Polo Martinez said Monday.

In an ambush interview, Martinez explained this was because excise taxes are shouldered by the importer.

“Nakita po ng panel na hindi po importer sila Sarah and Curlee and so they were not liable for non-payment of excise tax. Ang may liability po magbayad ng excise tax would be ‘yung nag import talaga. Kung kanino binili ang mga kotse,” he said.

(The panel found that Sarah and Curlee were not importers, and so they were not liable for non-payment of excise tax. The one liable to pay excise tax would be the party that actually imported the vehicles, from whom the cars were purchased.)

The spokesperson said the cases involved Land Rover/ Range Rover and Cadillac Escalade for one case; Land Rover and a Mercedes Benz for the second case; and a Mercedes Benz.

This is part of the five tax cases against the Discaya couple that underwent preliminary investigation at the Justice Dept.

Meanwhile, two cases will be filed at the Court of Tax Appeals.

“They concealed their true income in their ITRs for two taxable years. That’s taxable year 2020 and 2021. Ito pong concealment ginawa nila in their respective capacity as sole proprietors of St. Gerard Construction in the case of Curlee Discaya… and single proprietorship by Sarah Discaya,” he said.Sarah is currently committed at the Lapu-Lapu City Jail while Curlee is under the custody of the Senate.

In December 2025, the Office of the Ombudsman charged Discaya and others over a P96.5-million ghost flood control project in Davao Occidental.

She has pleaded not guilty to graft and malversation. —RF, GMA Integrated News