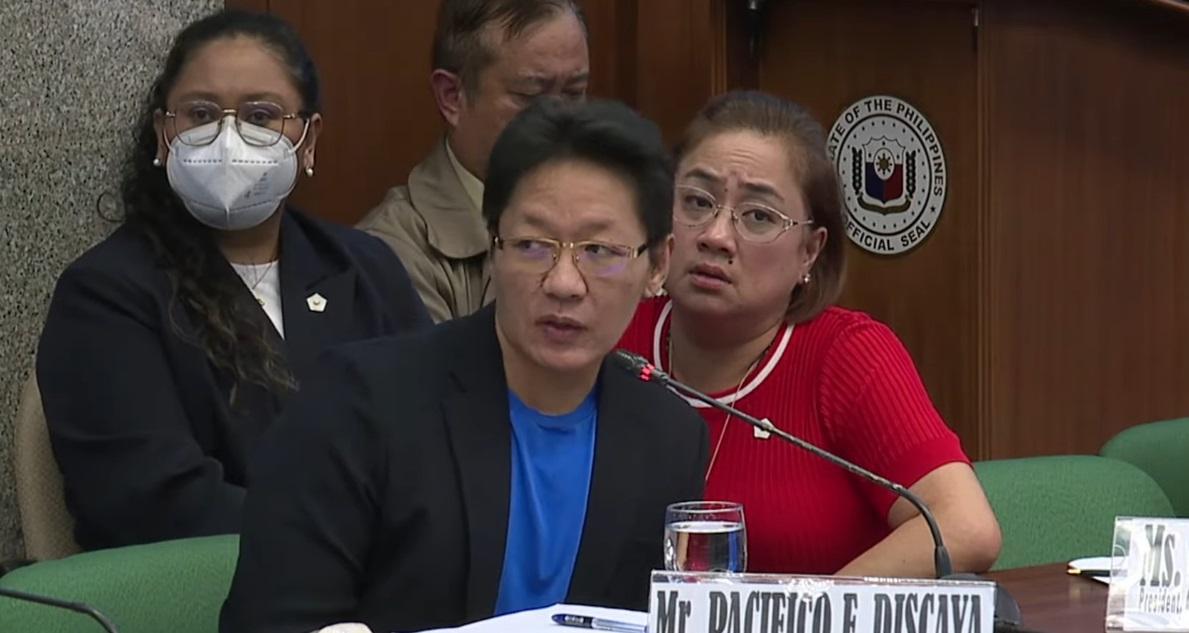

Dismissal of 3 tax complaints vs. Discayas won’t affect flood control cases —DOJ

The dismissal of the three excise tax complaints filed against contractors Curlee and Sarah Discaya will not have any effect on other flood control cases, Justice spokesperson Polo Martinez said Tuesday.

“The issue on the Discayas’ tax liabilities has nothing to do with any of the liabilities of others in the pending flood control cases. Neither did it involve misuse of public funds,” he said in a message to reporters.

According to Martinez, the DOJ panel of prosecutors dismissed three excise tax complaints filed by the Bureau of Internal Revenue against the Discaya couple and others over several luxury vehicles after finding that they were not the statutory taxpayers.

Martinez previously said that excise taxes are shouldered by the importer.

The spokesperson affirmed that the dismissal will also not affect any other case of the Discaya couple, saying it may only affect related tax cases of a similar nature.

Meanwhile, the DOJ will file two cases against the couple at the Court of Tax Appeals. These are for violations of Sections 254 (Willful Attempt to Evade or Defeat Taxes) and 255 (Willful Failure to Supply Correct and Accurate Information) of the National Internal Revenue Code of 1997.

Sarah is currently committed at the Lapu-Lapu City Jail.

In December 2025, the Office of the Ombudsman charged Discaya and others over a P96.5-million ghost flood control project in Davao Occidental.

She has pleaded not guilty to graft and malversation. —VAL, GMA Integrated News