ADVERTISEMENT

Filtered By: Money

Money

YEARENDER 2015

PHL stocks 20 | 15: The biggest winners and losers of the year

By JON VIKTOR D. CABUENAS, GMA News

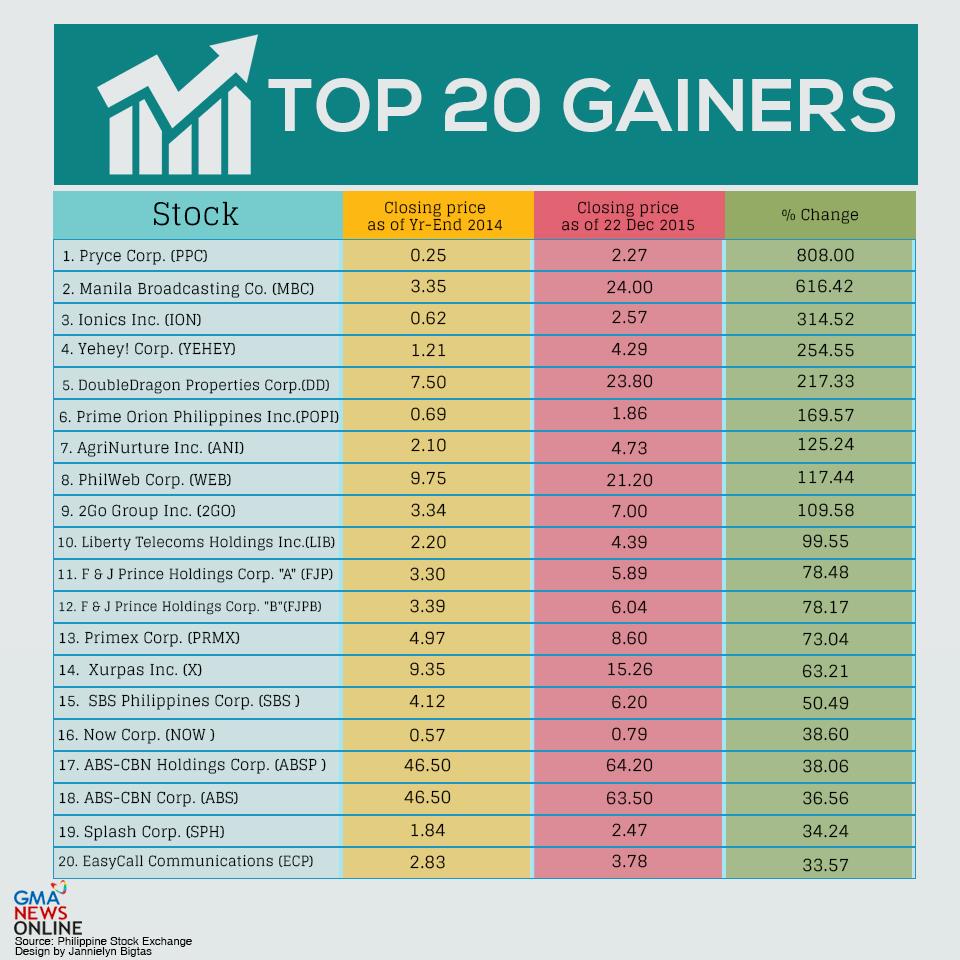

It may not be that obvious but the top 20 gainers on the Philippine Stock Exchange are not necessarily blue chip or index stocks.

The biggest winner is secondliner Pryce Corp. Its share price surged by more than 800 percent so far this year. The company owns and operates memorial parks in major cities in Mindanao. It also operates and manages hotels.

The only index stock on the list of winners and losers, compiled by GMA News Online, with a little help from the PSE Research Department and Public Investors Relations Department is Bloomberry. The resorts and gaming firm lost 66.13 percent in the year.

The Top 20 winners have surged by 167.831 percent on average, mainly driven by earning results and speculative trading that revolved on acquisitions.

"Most of the companies that have surged this year are mainly a combination of surge in profits and backdoor/acquisition speculations," Lexter L. Azurin, head of research at Unicapital Securities Inc. told GMA News Online.

On average, the Top 15 losers fell by 64.702 percent. Unicapital noted that most of the companies on the list were battered by external concerns.

Of the biggest losers, four are gaming companies – Melco Crown (Philippines) Resorts Corp., Premiere Leisure Corp., Travelers international Hotel Group Inc. and Bloomberry. These companies were mainly affected by the crackdown against gambling resort in Macau, Azurin noted.

Chinese gamblers have fled Macau amid Beijing's intensified crackdown on corruption. Most of the big time players, however, shifted to casinos in other countries, particularly Australia.

A handful of losers were commodities-related companies such as oil and mining firms, weighed down by the global economic slowdown and a slump in crude and metals prices.

The biggest loser is integrated casino developer Melco Crown due to its negative bottom line. Melco Crown registered a consolidated comprehensive loss of P1.177 billion in the three months to September.

2016 elections

Election money will benefit the stock market next year.

"For 2016, an election year, historically the stock market and the Philippine economy usually outperform during such years," Azurin noted.

"In terms of earnings growth, we expect profits of PSEi-listed firms to grow by an average of 13 percent. 2016 will continue to be a challenging year for the global markets due to external concerns, but we still think that the Philippine market may weather the storm," he said.

With only two trading days left in the year – December 28 and 29 – Azurin said he does not think there will be any drastic shift on the list of winners and losers for 2015. – VS, GMA News

Tags: yearender2015, phlstocks

More Videos

Most Popular