PLDT Q3 net income down 50% at P4.03B on faltering earnings

PLDT Inc., the country's largest telco, reported on Monday a 50-percent drop in bottom line for the third quarter of the year, hurt by lower earnings and higher costs.

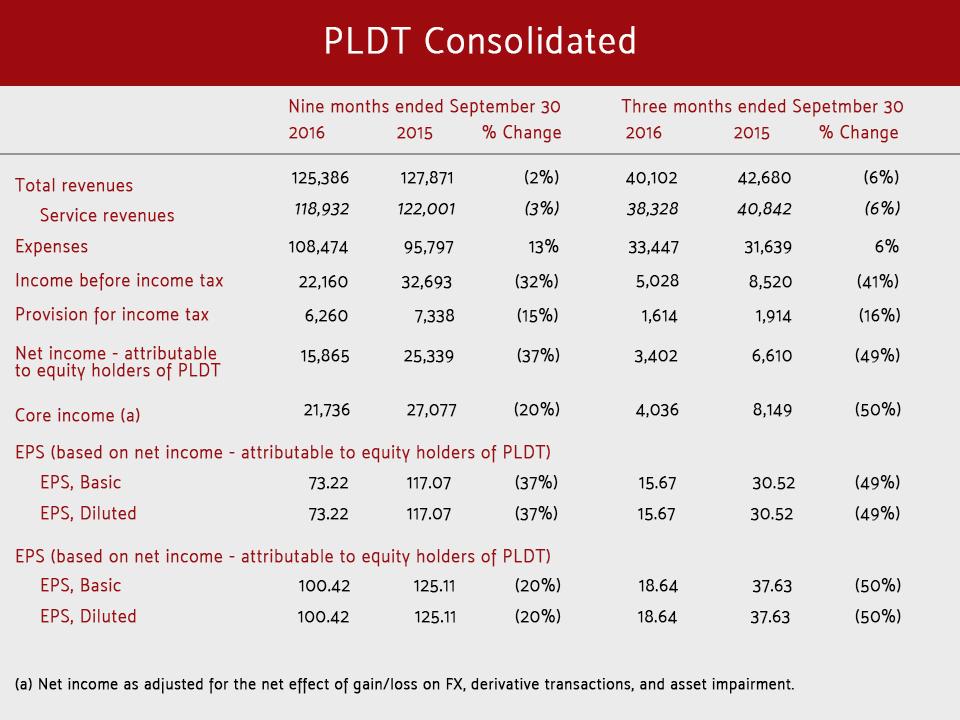

In a briefing in Makati City on Monday, the company said its third quarter core income was halved at P4.036 billion from P8.149 billion a year earlier.

Revenue fell by 6 percent at P40.102 billion from P42.680 billion in the same comparable period, while expenses grew by 6 percent at P33.347 billion from P31.639 billion.

"Weak revenue growth will result in a hit to the profit of most Asian telcos. EBITDA margins are likely to shrink the most in the Philippines and India, where telcos still derive the majority of their revenue from voice and text services," debt watcher Fitch Ratings said in a separate statement Monday.

EBITDA takes a hit

According to PLDT, earnings before interest, taxes, depreciation and amortization (EBITDA) took a hit "on account of lower wireless service revenues, a rise in product subsidies, content costs, and higher provisions."

The latest PLDT numbers brought its year-to-date core income down 20 percent at P21.736 billion from P27.077 billion in January to September 2015

Nine-month revenue dropped 2 percent at P125.386 billion from P127.871 billion year-on-year, while expenses rose 13 percent at P108.474 billion from P95.797 billion.

"Fiercer competition and rising capex needs will put pressure on the credit profiles of most Asian telcos over the next year, according to Fitch."We have a negative outlook on the telecoms sectors in India, Singapore, Malaysia, Thailand and the Philippines."

“In the light of our results thus far this year, we are adjusting our projected full year EBITDA to P60 billion, lower by P4 billion from the previous guidance. We are making this adjustment, anticipating that while data and broadband will keep posting steady growth, toll, cellular voice and SMS revenues will, however, continue to wane,” PLDT Chairman and CEO Manual V. Pangilinan said in a separate disclosure to the Philippine Stock Exchange.

“This year has been a particularly challenging period for PLDT, as we grappled with both intense price competition and the continuing shift from voice/SMS services to data demand impacting adversely our wireless revenues," Pangilinan added.

'Horrible year'

“It’s an annus horribilis (horrible year). Hopefully, 2017 will be annus mirabilis (a wonderful year),” Pangilinan told reporters at the briefing, noting the recent downtrend in the company’s financial performance prompted them to lower the income guidance for 2016.

“We slightly lowered our core income guidance for 2016 to P28 billion due to the decline in EBITDA, increases in financing costs, and depreciation due to higher capex, equity losses from the telco business acquired from San Miguel, offset by the net gain of the sale of PLDT’s 25-percent interest in Beacon,” he said.

PLDT and Globe Telecom Inc. co-acquired the telecom business of San Miguel Corp. for P69.1 billion.

This was followed by the sale of PLDT shareholdings in Beacon Electric Assets Holdings to Metro Pacific Investments Corp. (MPIC), another Pangilinan-led company, for a P26.2 billion.

At the same briefing on Monday, Pangilinan said the corporate outlook was also dampened by “fierce” competition for the year as mobile brands Smart Communications and TNT “lost about 17 million subscribers from 2013 to 2017.”

He said that wireless subscribers dropped to 65 million in the third quarter from 68 million in the second quarter, reflecting a loss of three million subscribers to main rival Globe Telecom Inc.

PLDT is currently undergoing a $1-billion three-year digital pivot from traditional phone services. — VDS, GMA News