Filtered By: Money

Money

BIR activates online interactive forms for income tax returns

By EARL VICTOR L. ROSERO, GMA News

In time for the deadline for the filing of annual income tax returns (ITRs) on April 16, interactive versions of the ITR forms can be downloaded from the website of the Bureau of Internal Revenue (BIR). The ITR forms for wage earners, self-employed, partnerships, and corporations are also available in Microsoft Excel (.xls) and Adobe Acrobat (.pdf) formats.

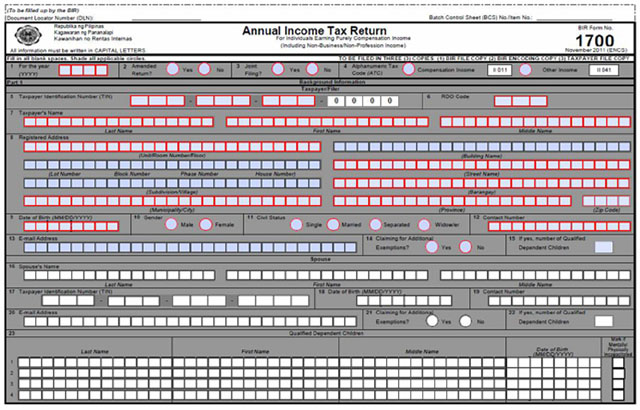

Shown here is the first page of the annual income tax return (ITR) form for taxpayers whose income is purely from compensation. The interactive ITR forms are downloadable from the website of the Bureau of Internal Revenue.

Tags: incometaxreturns

More Videos

Most Popular