Peso to settle at 49.20:$1 at year's end — economist

As a result of the trade deficit and the US interest rate hike, the Philippine peso will weaken further against the dollar at the 49:20:$1 level at year's end.

"The Philippine peso-to-US dollar exchange rate is expected to settle at 49.020 level on two things," Nicholas Antonio Mapa, associate economist at the Bank of the Philippine Islands, told GMA News Online.

Mapa attributed the forecast to the country's widening trade-in-goods deficit and the much anticipated interest rate hike by the US Federal Reserve in December.

"The widening trade deficit will continue to exert pressure on the peso as remittance growth has remained muted roughly at 3.2 percent year-to-date," the economist noted.

"The first eight months of the year saw the trade deficit balloon to $13.97 billion with no signs of a let up in imports as exports struggle given weak external demand," he added.

Mapa noted the faster-paced importation of construction materials as the government ramps up infrastructure spending is a big factor going against the local versus the US dollar.

The Duterte administration plans to boost spending on public infrastructure from 5.4 percent of gross domestic product (GDP) in 2017 to as much as 7.2 percent by 2022.

7-yr. low

"The Fed rate hike looms in December, with most foreign investors cashing in on gains and exiting from Philippine markets. The peso will track regional peers, that are all experiencing some depreciation pressure as capital flows back to the West," Mapa said.

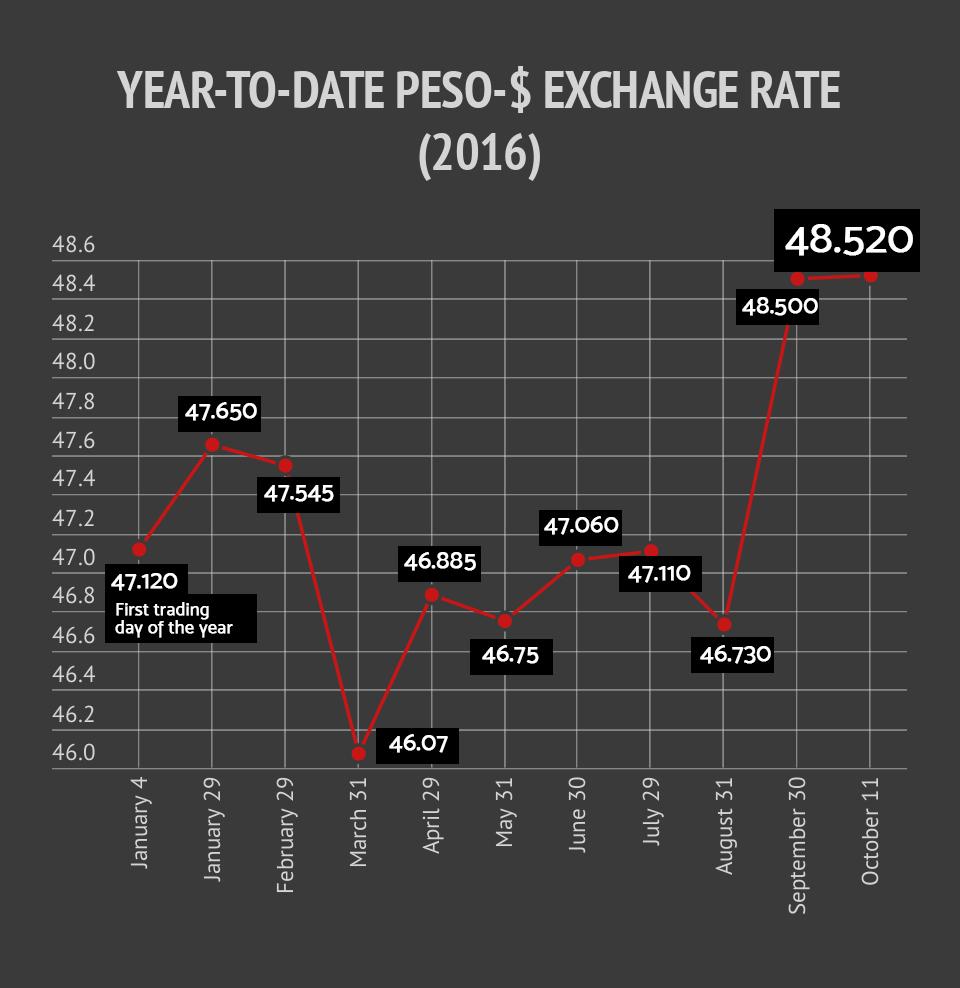

In late September, the local currency started depreciating to its lowest levels in seven years.

Notably, the peso began to weaken when President Rodrigo Duterte began his tirade against international bodies particularly the European Union, the United States, and the United Nations for criticizing the spate of extrajudicial killings, allegedly in relation to the government's campaign against illegal drugs.

Analysts attributed the peso's weakness to the outflow of foreign funds from the equities market, which boosts the demand for dollars as fund managers move profits out of the country, and the perceived political uncertainties on the domestic front.

The Philippine Stock Exchange has suffered 22 straight days of net foreign selling from August 23 to September 23.

However, economists and the administration's economic managers shun the idea of political uncertainty due to the President's pronouncements as the main reason for foreign capital outflows and pinned it instead to concerns about the possibility of US rate hike.

Credit watchdog Fitch's BMI Research is eyeing a deeper depreciation of P50:$1 at the end of the year.

Unorthodox policies

“We expect the Philippine peso to weaken further against the US dollar in the coming months due to market uncertainty over Duterte’s increasingly unorthodox policies,” BMI said.

It noted the peso would likely recover back to the 48:$1 level in 2017, primarily because of cash remittances from overseas Filipinos, low inflation and strong economic growth facilitated by the government’s expansionary fiscal plans, and rising net foreign direct investment.

“Over the longer term, we hold a slight appreciatory bias on the currency as healthy growth-inflation dynamics facilitated by a large and steady remittances inflow will be supportive of the currency,” BMI added.

Guian Angelo Dumalagan, market economist at the Land Bank of the Philippines, takes a contrarian view based on the inflow of money transfers by overseas Filipinos in the run up to the holidays in December.

“The dollar might probably end the year between 47.5 to 48.0. The peso might strengthen from its recent level due to seasonal remittance inflows in the last months of the year,” Dumalagan said.

“Moreover, the peso could also appreciate due to expectations of fewer political noise as the year comes to close. Currently, the peso's value is misaligned with the country's strong macroeconomic fundamentals because of domestic political uncertainties,” he added.

Dumalagan noted the position on the side of an appreciation might be limited as the US Federal Reserve is generally on track to raising interest rates by December 2016. — VDS, GMA News