With tax reform, more Pinoys may pay less income tax

Less taxes, more take-home pay. That’s just about any Filipino taxpayer’s wish while cringing at the salary deductions on his or her payslip.

This may soon become more than wishful thinking should the draft tax reform package submitted by the Department of Finance last September to Congress take effect.

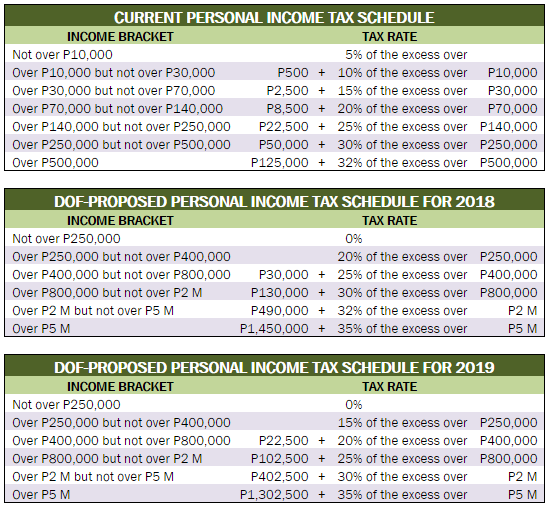

The proposal calls for adjustments in the personal income tax which will result in fewer taxable income brackets and lower tax rates, except for the richest taxpayers.

Although alternative calculations suggest that even the rich may stand to gain from the proposal, by all accounts any discussion to update the nearly two-decade old personal income tax schedule is a most welcome move.

Under the DOF proposal, minimum wage earners will remain exempt from paying personal income tax.

Based on prevailing Metro Manila rates, these are workers who earn just under P180,000 a year (less than P15,000 a month).

The DOF also proposes to expand the tax-exempt bracket to include those earning up to P250,000 a year (approximately P20,000 a month).

The current maximum tax rate, 32 percent, presently applies to those earning over P500,000. The DOF proposes to lower this rate to 30 percent, except for those earning over P5 million, who will shoulder a higher tax rate of 35 percent.

If the DOF proposal gets Congress’ approval without a hitch, the lower rates will be implemented starting 2018, with the rates further lowered by 2019.

To encourage compliance

The DOF’s sample computations illustrate how their proposed adjustments in the personal income tax schedule will affect taxpayers.

For instance, a teacher who earns P22,149 a month and pays an annual personal income tax of P33,328 under the current schedule will need to shell out only P1,092 in taxes in the first year of implementation of the proposed schedule.

A medical specialist with a monthly income of P73,299 will be taxed P145,265 instead of the current P197,827.

But a high-income earner who makes P877,500 a month will have to pay more personal income tax.

From P3.5 million under the current schedule, he or she will have to shell out P3.6 million in the first year of implementation of the proposed schedule.

University of the Philippines economics professor Renato Reside Jr. welcomes the DOF’s proposal to lower the personal income tax rates. One of the economic principles of taxation, he says, is to ease the tax burden of those who have less ability to pay, while those who can afford to pay more taxes should pay more.

Hopefully, with fairer taxation, the willingness to pay will follow. “That’s one of the appeals of lowering the rates – to encourage compliance by taxpayers, to encourage them to file and pay properly, to be compliant with the law,” Reside said.

Sonny Africa, the executive director of the non-government think-tank Ibon Foundation, likewise welcomes what he describes as a “well-deserved” adjustment in the income tax burden of the low- and middle-income class. However, he cautioned that the DOF may also be relieving the rich in the process.

Africa provided Ibon’s sample calculation, itself based on DOF’s proposed tax rates, to illustrate his point. The sample computation showed that those earning P5 million will end up paying P262,500 less in taxes if the DOF’s proposal is fully implemented: from P1,565,000, the personal income tax of these earners will go down to P1,302,500 by 2019, he said.

Equitable distribution

“Even if they [DOF] are saying that the tax rates for the richest Filipinos will remain high, actually it will not be the case,” Africa said.

“Since the tax brackets were also adjusted, there will be a net decrease in the amount of taxes that the richest Filipinos will be paying,” he added.

Distributing the tax burden equitably to remedy the scenario Africa pointed out can be the subject of further discussion and recalibration once the DOF proposal goes through the legislative mill.

For Tax Management Association of the Philippines president Atty. Benedict Tugonon, that tax reform is even on the table is progress in itself. It’s a discussion that is long overdue. Much has changed since 1997 when the personal income tax rates were last set, and yet efforts to update the rates have repeatedly stalled due to the long and difficult process of legislation.

“Back then, P500,000 was considered a fortune that would rank one among the richest,” Tugonon said.

But over time the value of this amount has eroded. “Today, many ordinary families earn P500,000, and they are being taxed at the maximum rate. This is why we really need to update the schedule,” he explained.

To prevent the income tax rates from getting stuck in the past all over again, the DOF proposal threw in a provision that would index or adjust the income levels to inflation once every five years after 2019.

Future adjustments will no longer require legislation, as the provision authorizes the Secretary of Finance to issue rules and regulations to effect such adjustments.

The proposal to reduce income tax is only one part of the DOF’s tax reform package. The other half of it, entailing the removal of value added tax exemptions and raising excise taxes, may yet leave Filipino taxpayers cringing despite the supposed increase in their take home pay. — with reports from Lei Alviz/RSJ/KG/VDS, GMA News