Inflation quickens to 3.4% in March, fastest in over two years

Prices of consumer goods rose by more than 3 percent in March, the highest in over two years, the Philippine Statistics Authority (PSA) said Wednesday.

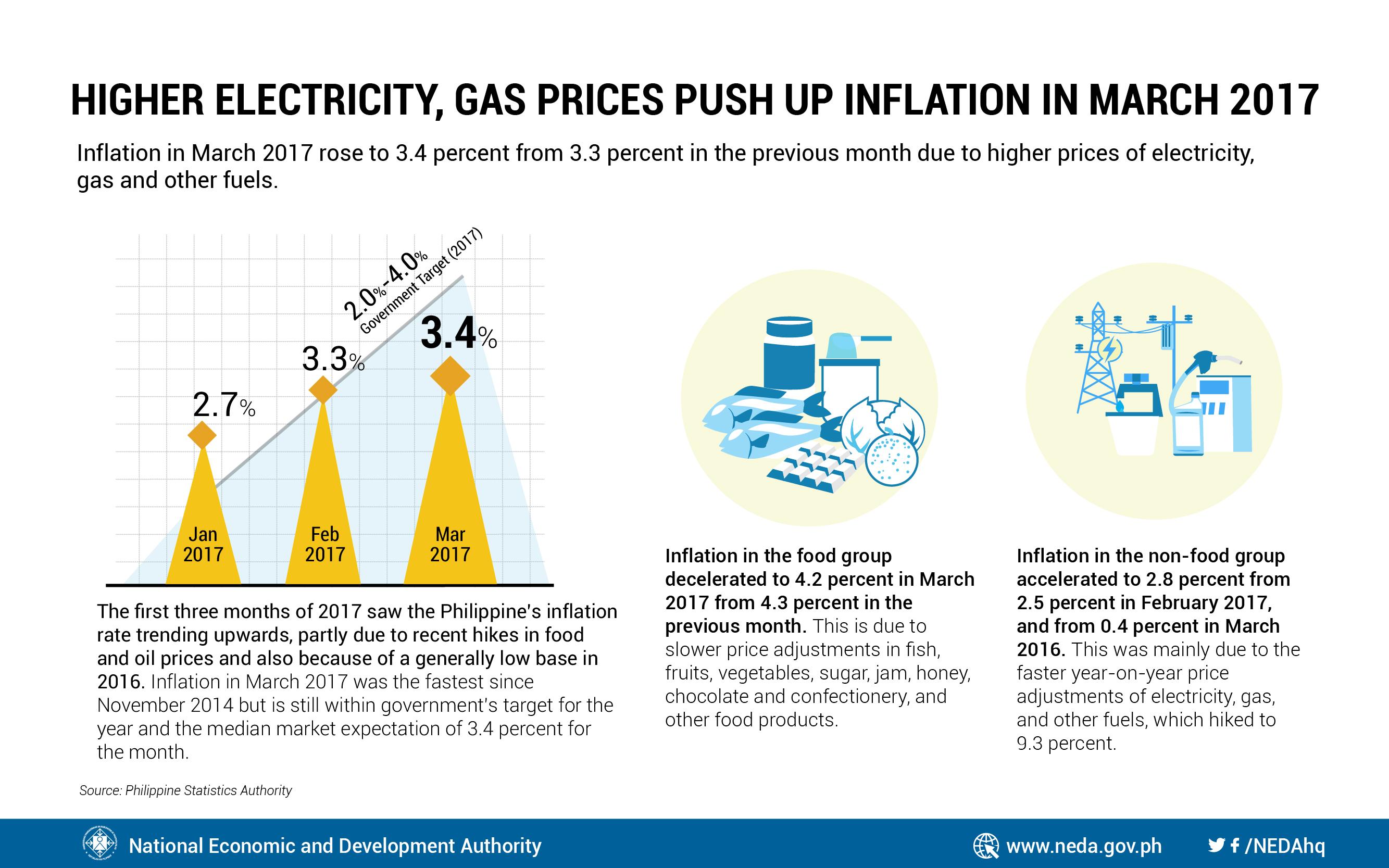

Inflation registered at 3.4 percent in March, the fastest since 3.7 percent in November 2014, on the back of higher electricity and petroleum prices.

"Higher charges for electricity rates were observed in all regions during the month. Ship fare hikes and upward adjustments in the prices of gasoline, diesel, LPG, alcoholic beverages and cigarettes were also recorded in NCR (National Capital Region) and in many provinces," the PSA said.

"Higher charges for electricity rates were observed in all regions during the month. Ship fare hikes and upward adjustments in the prices of gasoline, diesel, LPG, alcoholic beverages and cigarettes were also recorded in NCR (National Capital Region) and in many provinces," the PSA said.

Meralco implemented a P0.66-per-kilowatt-hour (/kWh) increase in March, bringing the overall rate for the month to P9.67/kWh.

Inflation in February clocked in at 3.3 percent registered and was at 1.1 percent in March 2016.

Seasonally Adjusted Summary Report March 2017 by GMA News Online on Scribd

Within estimates

The latest inflation number falls within the 3.0 to 3.8-percent range estimated by the Bangko Sentral ng Pilipinas (BSP), and slightly lower than the 3.6-percent as projected by the Department of Finance.

“As we have said, our runs show that the path of monthly inflation shows upticks until about the third quarter of this year before slowly decelerating to average within the target range,” BSP Governor Amando M. Tetangco, Jr. said in a text message to reporters.

Economists noted the 3.4 percent rate is in line with expectations, given the depreciation of the Philippine peso.

"The uptick in March is aligned with market expectations and is consistent with the peso's further depreciation," Land Bank of the Philippine market economist Guian Angelo Dumalagan said in a text message.

Dumalagan noted the "moderate" rise in headline inflation also gives the Bangko Sentral ng Pilipinas ample room to keep policy rates steady in the next couple of months, "but does not preclude the possibility of at least a single rate hike within the year."

“While we don't see any immediate need to tweak policy rate settings, we are watching the international oil supply picture, developments in the CTRP (comprehensive tax reform program), geopolitical developments, among others. We will make adjustments if and when needed,” Tetangco noted.

While inflation remains tilted to the outside, it still falls in line with the government’s target, Socioeconomic Planning Secretary Ernesto M. Pernia said in a separate statement.

“Upward risks to inflation remain, but the overall outlook continues to be within government’s 2.0-4.0 percent target range from this year and next,” he said.

Remittances, weak peso

From the academe, the inflation rate last month reflected the strong remittances from overseas Filipinos and domestic consumption.

"The inflation of 3.4 percent is expected in a consumption driven economy, as well as strong remittances," said Economics Professor Emmanuel Leyco of the Asian Institute of Management.

"Also, the depreciation of the peso has an inflationary impact. However, the 3.4 percent is still manageable. I even expected 3.5 percent inflation," Leyco noted.

Among the inflation drivers over the near-term horizon are electricity rates, with a rate increase being tackled by the Energy regulation Commission (ERC).

“Higher electricity rates are expected to persist in the next two months as the ERC will spread the additional cost from the use of liquid fuel, which is more expensive than natural gas, until May 2017,” Pernia said.

But the quantitative restrictions (QR) on rice importation, which lapses this year, may bring down inflationary pressures, the Cabinet official said.

“Inflationary pressure may ease following the removal of QR on rice importation, and the timely augmentation of supplies. However, the likely recovery of international and petroleum prices in 2017 may keep consumer prices afloat,” said Pernia.

“The recent upward trend in inflation needs to be closely monitored. The government needs to implement timely mitigating measures to ensure that prices remain stable,” he added. — ALG/VDS, GMA News