BSP chief Diokno: ‘Bad loans’ lagging indicators, FIST bill passage needed ASAP

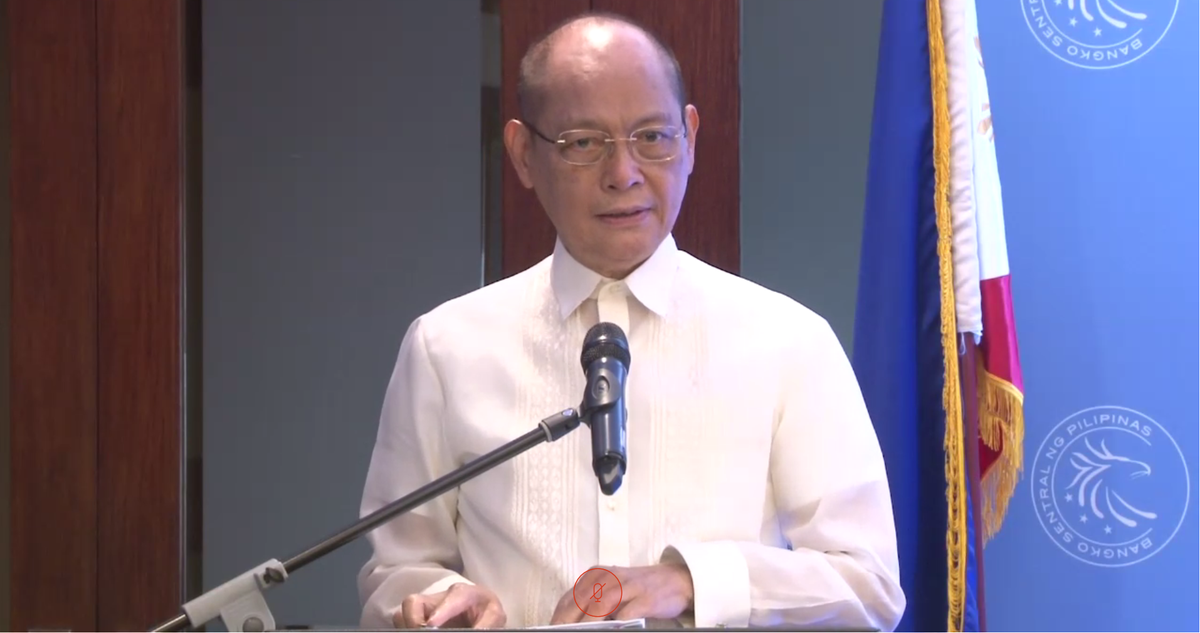

Bangko Sentral ng Pilipinas (BSP) Governor Benjamin Diokno on Wednesday pushed for the speedy passage of the Financial Institutions Strategic Transfer (FIST) bill as he cited the increasing non-performing loans (NPL) or those that are not being settled by borrowers in the country.

During the hearing of the Senate Committee on Banks, Financial Institutions and Currencies, Diokno cited a baseline survey conducted by the BSP among "top banks" to gauge the impact of COVID-19 in their operations.

"NPL ratio is estimated to double from 2.4% as of end March 2020 to 4.6% by end December 2020 as borrowers capacity to pay may be weakened by disruption in their cash flows," he said.

Despite previously saying that this expected increase in "bad loans" are manageable, Diokno acknowledged that non-performing loans and assets ratios are "lagging indicators" because they build up over time.

Diokno stressed that the government must enact the FIST as soon as possible, learning from its experience during the 1997 Asian Financial Crisis.

The banking sector entered the 1997 Asian Financial Crisis with strong fundamentals, and the banking system's capital adequacy ratio was at the minimum standard of 8% and its NPL ratio was at a low of 4%, according to the BSP chief.

However, a drastic change was observed five years later because of the late implementation of interventions to manage these non-performing loans.

"This delay contributed to the deterioration in the asset quality of the banking system with the NPL ratio at the banking sector kicking in June 2002, five years later, at 18.6%," Diokno said.

National Economic and Development Authority chief Karl Chua, during the same hearing, mentioned a slightly higher figure for NPLs.

"With NPLs already at 7% today and estimated by BSP to further increase to double digits, so in a sense, this FIST bill will have to be able to improve the equity of how we support micro, small, and medium enterprises," he said.

Chua stressed that mostly exhibited by smaller banks including thrift banks and cooperative banks.

He also lobbied for the passage of the FIST amid the COVID-19 pandemic.

"The financial system is like the circulatory system of the body. We do not want to wait for a stroke or a heart attack to happen," he said.

Bankers Association of the Philippines president Cezar Consing agreed that had the Special Purpose Vehicle Act of 2002 been enacted earlier during the Asian Financial Crisis, the banking sector could have suffered less.

"I thought it was late and had it come one or two years earlier, the effect would have been more dramatic and positive," Consing said.

The FIST bill seeks to facilitate the sale of non-performing assets of public and private financial institutions amid the COVID-19 pandemic.

It aims to create specialized asset-managing corporations that would acquire "bad loans and stagnant properties" from embattled financial institutions.

The counterpart FIST bill in the House of Representatives has already been approved on third and final reading in June.

Senator Grace Poe, chairing the panel in the upper chamber, adjourned the hearing and vowed that the technical working group will diligently work for its timely passage. — RSJ, GMA News