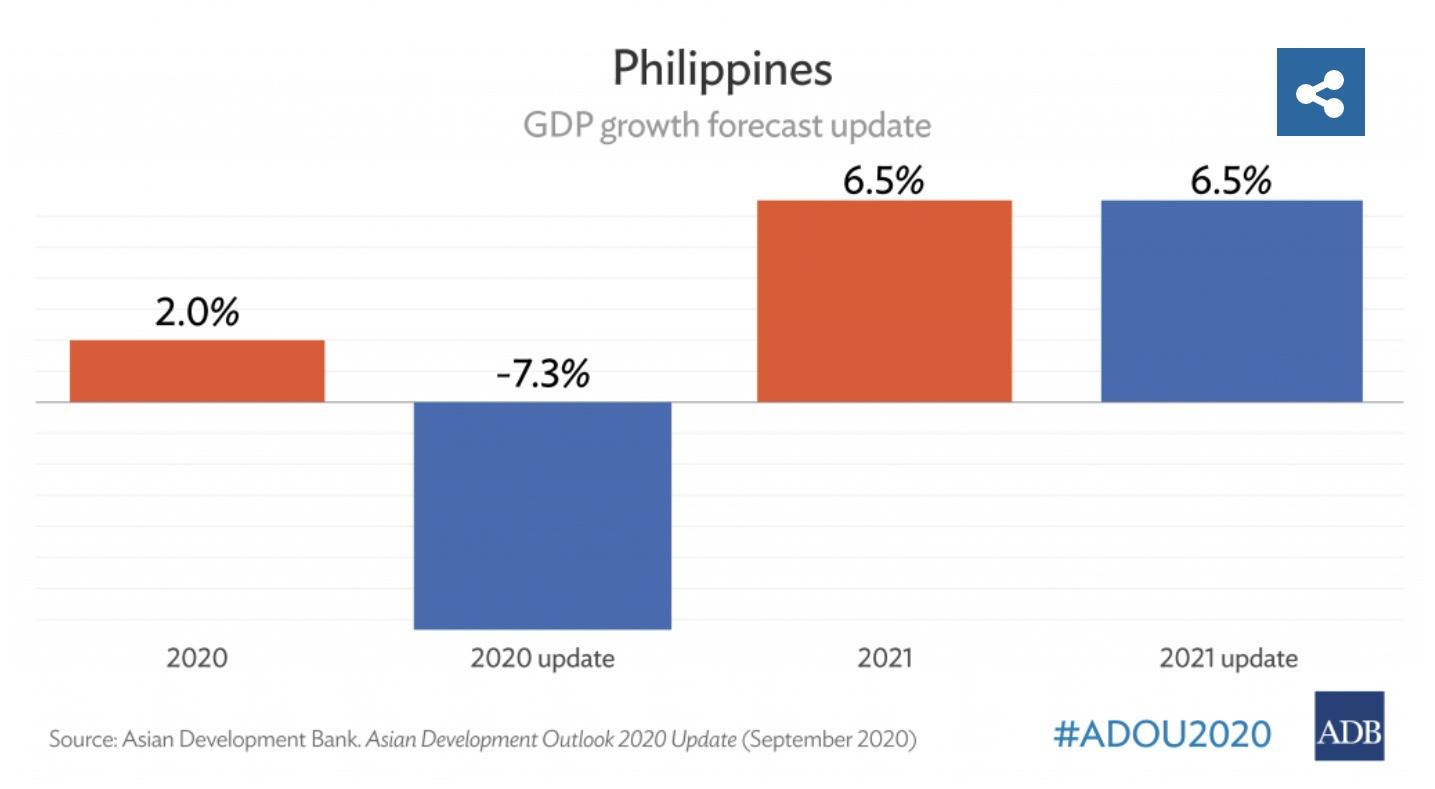

ADB sees Philippine economy to dive deeper by 7.3% in 2020

Philippine economic growth is seen to contract further by as much as 7.3% this year, but a dramatic recovery is expected next year as the economy has already opened and the COVID-19 contained, the Asian Development Bank (ADB) said Tuesday.

In its Asian Development Outlooks 2020 Update, the ADB now sees a deeper decline in the country’s economy than its April forecast of -3.8%.

The greater economic slump forecast is attributed to subdued private consumption and investment expected for the rest of the year and uncertainties about the global economic recovery.

The Philippine economy, however, is seen to grow by 6.5% in 2021, according to the multilateral lender.

The ADB said the country’s economy is expected to rebound in 2021 as the outbreak is contained, the economy is further opened, and more government stimulus measures are implemented.

But the downside risks next year include a slower than expected global recovery that could weigh heavily on trade, investment, and overseas Filipino worker remittances.

“We believe the worst is now over and that the contraction in GDP bottomed out in May or June this year,” ADB country director for the Philippines Kelly Bird said.

“The package of measures the government rolled out such as income support to families, relief for small businesses, and support to agriculture in the second quarter all helped the economy to bottom out,” Bird said.

“We expect the recovery to be slow and fragile for the rest of this year, and growth to accelerate in 2021 on the back of additional fiscal support and an accommodative monetary policy stance,” he said.

Following a contraction of 9.0% in the first half of 2020, a slow economic recovery is expected to start in the second half of 2020, as the government’s fiscal response gains traction and household consumption slowly picks up on a jobs rebound, according to the ADB.

The lender noted that following the relaxation of community quarantines in June, the employment situation in July improved markedly from April.

Unemployment rate eased to 10% equivalent to 4.6 million adult Filipinos jobless in July from record-high of 17.7% or 7.3 unemployed individuals in April, due to the gradual reopening of businesses following months of strict lockdowns against COVID-19’s spread.

The services sector was the main job creator with 3.4 million jobs added between April and July, followed by the agricultural and industrial sectors, with 2.1 million and 2 million, respectively.

The ADB also noted that government is preparing an additional fiscal support package to be implemented in September which is expected to include cash subsidies to poor households; support for displaced workers and critically affected sectors such as agriculture, tourism, and transportation; and relief to the health care system, among other measures.

“Such measures will have high multiplier effects and keep the economy on track to recovery next year,” it said.

President Rodrigo Duterte on Friday signed the Bayanihan to Recover as One Act which provides a COVID-19 relief package worth P165.5 billion.

“ADB has thrown its full support to the government’s COVID-19 response, delivering a combination of loans and grants to help finance measures aimed at lessening the pandemic’s impact on lives and livelihoods,” Bird said.

The ADB has so far provided about $2.3 billion in loans and grants to support the Philippine government’s urgent COVID-19 response, including social protection and livelihood support to help mitigate the impacts on livelihoods and employment and assistance to further scale up the government’s health response against the pandemic.

The report revised the Philippines’ inflation forecasts to 2.4% in 2020 and 2.6% in 2021, compared with the April projections of 2.2% and 2.4%, respectively, as global oil prices stabilize.

The forecasts are within the Bangko Sentral ng Pilipinas’s target range of 2.0%–4.0%, with monetary policy likely to continue to help the economy’s rebound from the pandemic.—AOL, GMA News