P2.2T infused into financial system from accommodative policy, liquidity easing —BSP

Over P2 trillion was infused into the financial system from the accommodative policy and liquidity-easing measures, the Bangko Sentral ng Pilipinas (BSP) reported Thursday.

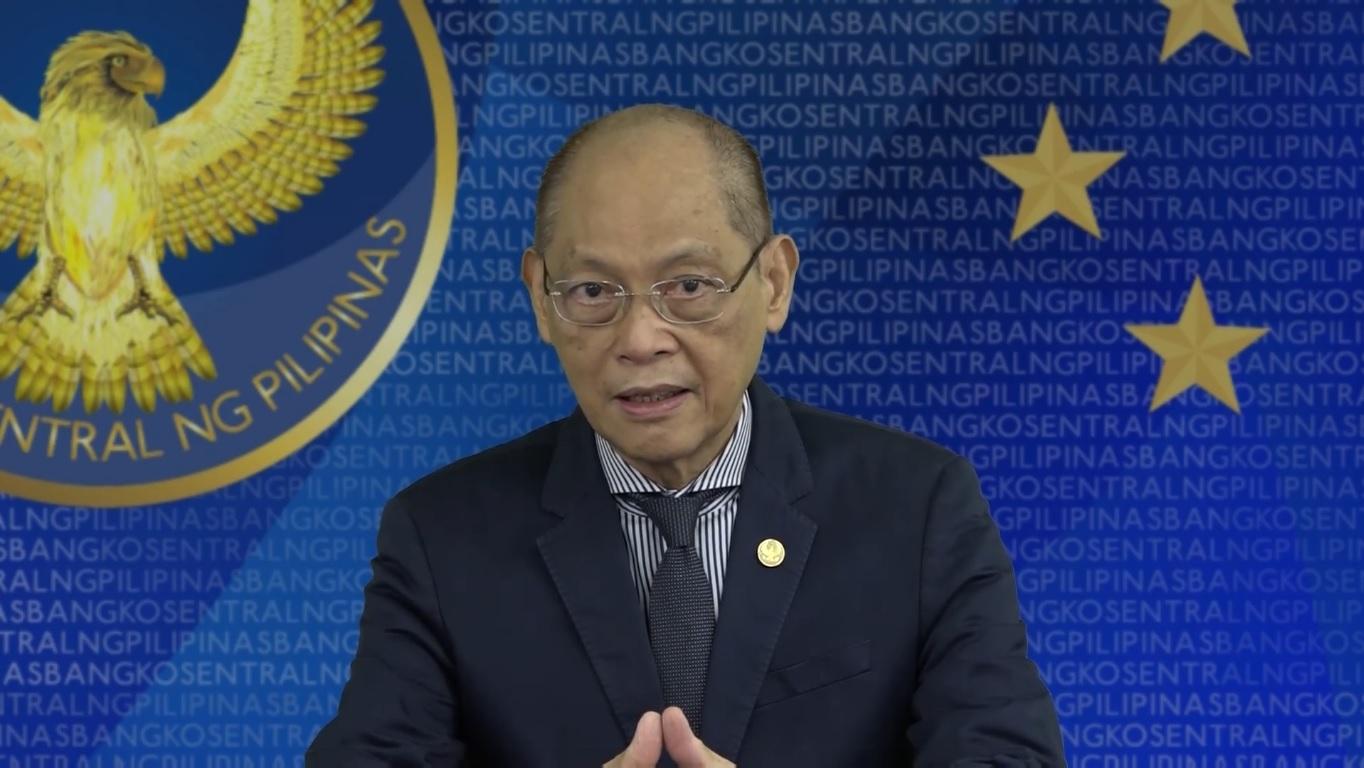

In a virtual briefing, BSP Governor Benjamin Diokno said P2.2 trillion liquidity was injected into the system as of June 3, 2021, equivalent to 122.13% of the gross domestic product (GDP).

"Amid heightened uncertainty in the COVID-19 pandemic, monetary policy has continued to focus on supporting economic activity and market confidence," Diokno said.

"Thus, the BSP decided to mobilize its monetary instruments and other extraordinary measures to avert liquidity strains and to prevent long-lasting scarring in the domestic economy," he added.

The central bank slashed key policy rates by 200 basis points in 2020 -- 25 basis points in February; 50 basis points each in March, April, and June; and another 25 basis points in November.

The BSP also lent the national government P540 billion in provisional advances, and P300 billion in the form of securities.

The BSP also reduced the reserve requirement for all universal and commercial banks by 200 basis points in March 2020, and by 100 basis points for thrift, rural, and cooperative banks in July last year.

"As a result, domestic liquidity conditions remain at a healthy level to support economic activity," said Diokno, noting the improved market sentiment.

Latest data available from the central bank show that the money supply grew 5.1% to P14.2 trillion in April.

"This allowed the BSP to slowly recalibrate and normalize its monetary operations," Diokno explained.

"The adjustments to our monetary operations, in time with the gradual reopening of the economy, should help facilitate the transmission of our accommodative stance to lower market rates, increased lending, and ultimately, to robust economic activity," he added.—LDF, GMA News