Dominguez: Balancing health, economic concerns key to Philippine recovery

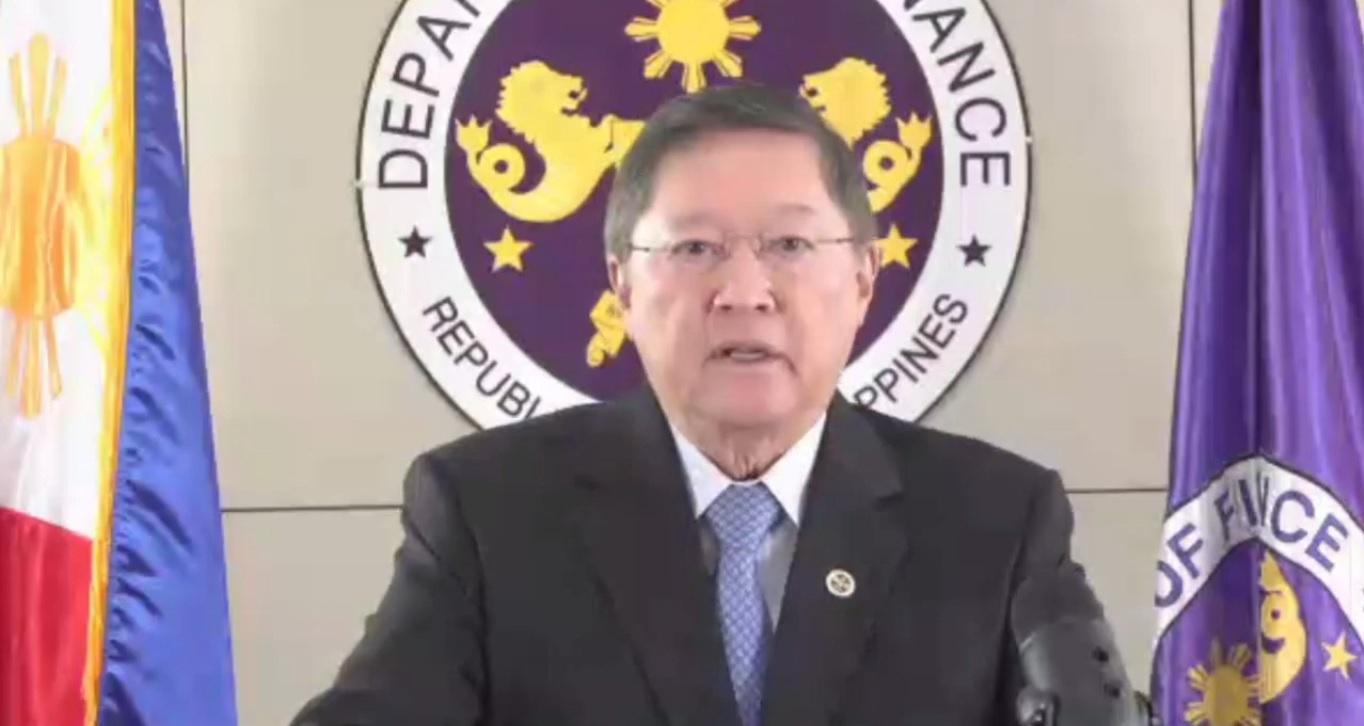

A strategy of balancing economic concerns with the health requirements of the COVID-19 response will drive the Philippines back to its pre-pandemic path of rapid economic growth, Finance Secretary Carlos Dominguez III said Tuesday.

At a virtual economic briefing hosted by the Sumitomo Mitsui Banking Corporation (SMBC), Dominguez told over 300 Japanese business leaders that the better-than-expected performance of the Philippine economy, which grew 11.8% in the second quarter over the same period last year, demonstrates the clear results of this balancing strategy.

Three senators had earlier pointed out that improving 11.8% from a 16.9% contraction was "nothing to brag about," and that the economy still had a long way to go before returning to pre-pandemic level.

Dominguez, however, declared that the rebound was driven by more than just base effects. “This is the result of a better balance between meeting the exigencies of economic concerns and the health requirements of our COVID-19 response. This underscores the strong capacity of the Philippine economy to return to the path of rapid expansion,” he said.

In his presentation, Dominguez also said that the government is improving revenue generation through digitalization; increasing public spending on infrastructure, health care and other social services; and consistently exercising fiscal responsibility by keeping the budget deficit and debt-to-gross domestic product (GDP) ratio within manageable levels to “blaze a clearer path to recovery.”

The Finance chief said both poverty and unemployment remain the primary concerns of the Duterte administration, which is why it plans to continue investing in the Philippines’ young and skilled workforce.

President Rodrigo Duterte also intends to rapidly modernize governance, continue with market-friendly reforms that are attractive to investors, and intensify the government’s climate change actions during the remaining period of his term, the Finance chief said.

Inviting the Japanese investors to take a closer look at the Philippine economy “and take part in its strong resurgence this year and beyond,” Dominguez also said the Duterte administration already has a plan in place to assist the next administration in addressing possible fiscal and economic risks.

To ensure a legacy of a “dynamic and market-driven economy for the Filipino people,” Dominguez said that in the remainder of its term, the Duterte administration will push to further deepen the Philippine capital markets by building a sustainable corporate pension system; and seek amendments to the Foreign Investments Act (FIA), the Public Service Act (PSA) and the Retail Trade Liberalization Act (RTLA) which, he said, would spur more innovation, better products and services, and jobs.

The administration is also eyeing a clean energy plan for Mindanao, a law banning single-use plastics to be passed in Congress, and the continuation of its “Build, Build, Build” program by spending above 5% of GDP on infrastructure until the end of its term, Dominguez said.

CREATE

The Duterte administration is likewise committed, he said, to pursuing the remaining packages of its Comprehensive Tax Reform Program (CTRP), which aim to improve the real property valuation system and reform the taxation on passive income as well as financial intermediaries.

Dominguez said “there is much economic energy waiting to be unleashed in the coming period,” with the Philippines’ recovery getting a boost from the implementation of the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Law.

With almost 220 billion yen or about P100 billion worth of tax relief to be granted to enterprises annually in the form of lower corporate income tax (CIT) rates, CREATE is the largest economic stimulus program for businesses in recent history, he said.

Dominguez added that CREATE will enable the Philippines to attract high-value investments by incentivizing industries that will introduce new technologies and innovations, and create more jobs through a rationalized fiscal incentives system.

Dominguez also cited the implementation of reduced personal income taxes (PIT) for 99% of Filipino taxpayers starting in 2018 under the Tax Reform for Acceleration and Inclusion (TRAIN) Law, as another key intervention on top of CREATE that “will bring better business conditions in the near term.”

“Even as we intend to harness the trapped economic energy to produce rapid growth, we need to ensure that fiscal responsibility is constantly observed. We must be prepared to fight a long battle by conserving our resources well,” he said.

COVID-19

The Finance chief also noted that the government has been beefing up its COVID-19 vaccination program, with 15.3 million Filipinos as of September 6 having been fully inoculated against the virus.

“So far, the Philippines’ vaccination program is in the right direction. We have been receiving a steady supply of vaccines from multiple sources and have been vaccinating our people apace,” he claimed.

Dominguez thanked the Japanese people who, through the government of Japan, donated more than 1 million doses of AstraZeneca vaccines to the Philippines last month.

The 142 million doses of vaccines that will be added to the current stock of 52.8 million received so far by the Philippines are expected to be delivered by pharmaceutical companies by the end of this year, he said.

While its debt-to-GDP ratio rose to 54.6% in 2020 owing to unplanned spending spawned by the pandemic, Dominguez said the Philippines is still in a better position than other countries because it entered that year with a historic low ratio of 39.6%, while others were already struggling at 60%.

The Philippines’ debt-to-GDP ratio will begin its downward path in 2023, he forecast.

Dominguez said he expects tax revenues to reach the pre-pandemic level of P3.3 trillion or equivalent to 15% of the Philippines’ GDP in 2022, and P4.1 trillion in 2024.

Public spending is expected to rise to about P5 trillion or 22% of the Philippines’ GDP in 2022 to largely fund investments in infrastructure, healthcare and other social services, including the procurement of COVID-19 booster shots.

Starting in 2022, he said revenues are projected to exceed the growth in expenditures, which will translate into a narrowing budget deficit of 7.5% of GDP by 2022, from 9.3% in 2021.

This will further settle at 4.9% by 2024, Dominguez said. — BM, GMA News