Government grants tax holiday, incentives to Makati City Subway

The Makati City subway project will be granted a four-year income tax holiday followed by five years of tax incentives, the Department of Finance (DOF) announced Monday.

According to the DOF, the Fiscal Incentives Review Board (FIRB) approved the incentives which include the tax holiday, and five years of enhanced deductions and duty exemption on importation for the construction, operation, management, and maintenance of the rail project.

“The incentives approved will not apply to the other business activities that would be generated from the subway operations,” the DOF said in an emailed statement.

The incentives exclude the lease of retail areas and advertising, which will be subject to the regular corporate income tax rate and other applicable taxes.

Philippine Infradev Holdings Inc. in July 2019 got the approval of the Makati City Council for the terms and conditions of the project, covering the construction, operation, and management of a subway system within the city.

The city government in October 2018 awarded the public-private partnership project to the consortium of Philippine Infradev (formerly IRC Properties), to be implemented via a joint venture agreement.

The consortium counts as members Philippine Infradev and its Chinese partners Greenland Holdings Group, Jiangsu Provincial Construction Group Co. Ltd. Holdings Ltd., and China Harbour Engineering Company Ltd.

Philippine Infradev broke ground for the subway project in December 2018.

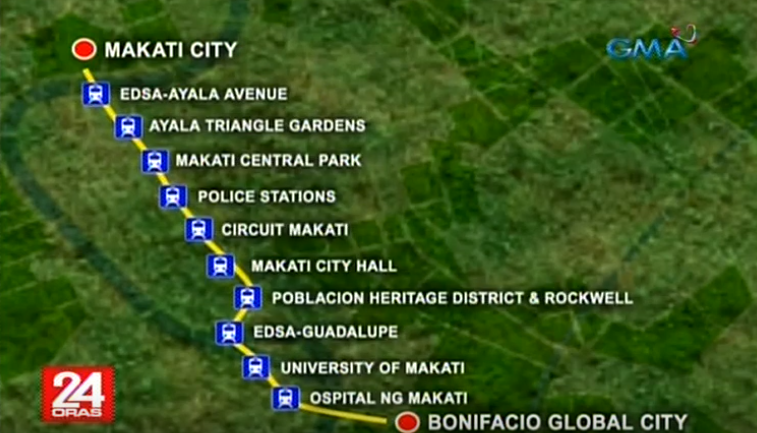

The subway system is seen to significantly ease traffic congestion in Makati by providing an alternative transport service for up to 700,000 commuters, and reducing the number of vehicles plying the streets of the city to 270,000.

The DOF said it took into consideration the projected annual increase in economic productivity of P24.4 billion, once the subway becomes operational in 2026.

“This will be monitored, along with the other projected benefits, in accordance with the principle of granting incentives based on merit or performance embodied in the Corporate Recovery and Tax incentives for Enterprises (CREATE) Law,” it said. —KG, GMA News