Gov’t ‘revisiting’ VAT exemptions to address inefficiencies, leakages — DOF’s Diokno

The government is reviewing value added tax (VAT) exemptions in a bid to address inefficiencies and revenue leakages in the tax system, Finance Secretary Benjamin Diokno said Wednesday.

“We will review the exemptions and revisit once and for all kung ano ba yung reasonable na gawin (what reasonable measures should be done),” Diokno said at the Kapihan sa Manila Bay forum.

The Tax Code lists 29 transactions exempted from VAT to ease the burden on consumers and small businesses. Most of the VAT-exempt transactions include unprocessed agricultural and fisheries products as well as educational, health, and financial services.

Asked if all exemptions should be removed, the Finance chief said, “Not necessarily. There are some worthwhile exemptions —educational institutions, hospitals.”

Diokno said the list of transactions to be removed from VAT exemption will be out “before the end of the year.”

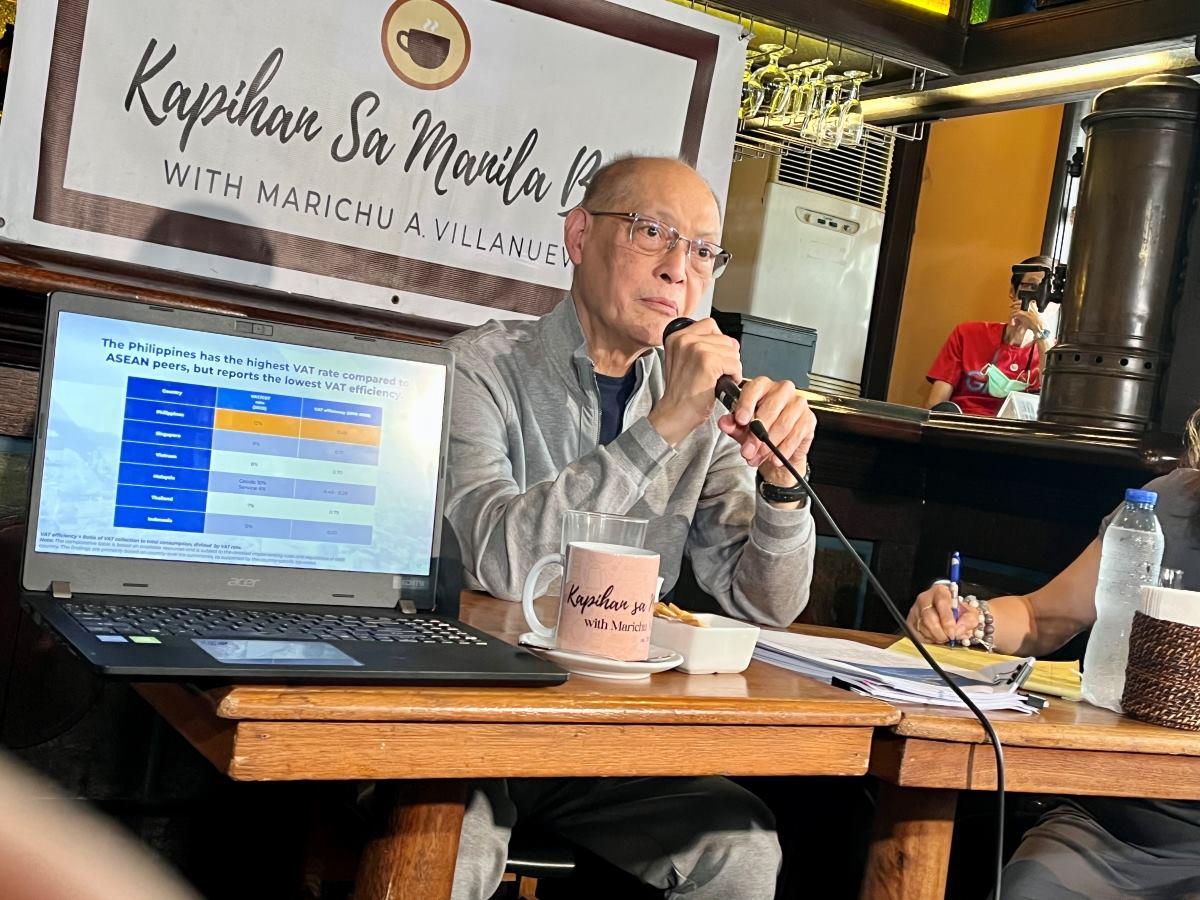

The Finance chief noted that the Philippines, relative to its ASEAN peers, despite having the highest VAT rate of 12% “our VAT efficiency is only 40%.”

“That means there’s still some room for improvement for VAT collection,” Diokno said.

“Without exemptions, zero rating, and at 100% efficiency, it is estimated that the government has to be collecting VAT equivalent to approximately 10.7% of GDP. At present, we are only collecting around 4.7% of GDp which makes the combined tax policy and administrative gap to around 6% of GDP,” he added.

Diokno emphasized that under the existing policy structure for VAT — taking into account the existing VAT exemptions and zero rating — the administrative gap computed for 2018 is P546 billion, or equivalent to 3% of GDP.

The potential VAT collection in 2018 without exemptions, he said, was supposed to be P1.85 trillion but the actual VAT collection was only P784.2 billion.

“This is 41.6% of potential revenue under the existing policy structure. This revenue loss would be higher if we introduce more exemptions to the VAT system. The government cannot afford to lose additional revenues on VAT,” Diokno said.

“It is also for this reason that the DOF does not support any legislative or non-legislative proposals that would further erode the VAT revenue base,” he added.

The administration’s chief economic manager said the Department of Finance (DOF) has asked the International Monetary Fund (IMF) for technical assistance to revisit the implementation of the VAT.

“So we can address these gaps… and develop appropriate reform measures to make collections more effective, more efficient, and more responsive to the country’s economic activity,” he said. — RSJ, GMA Integrated News