BSP’s Remolona: Interest rate cut on the table if inflation falls to 4%

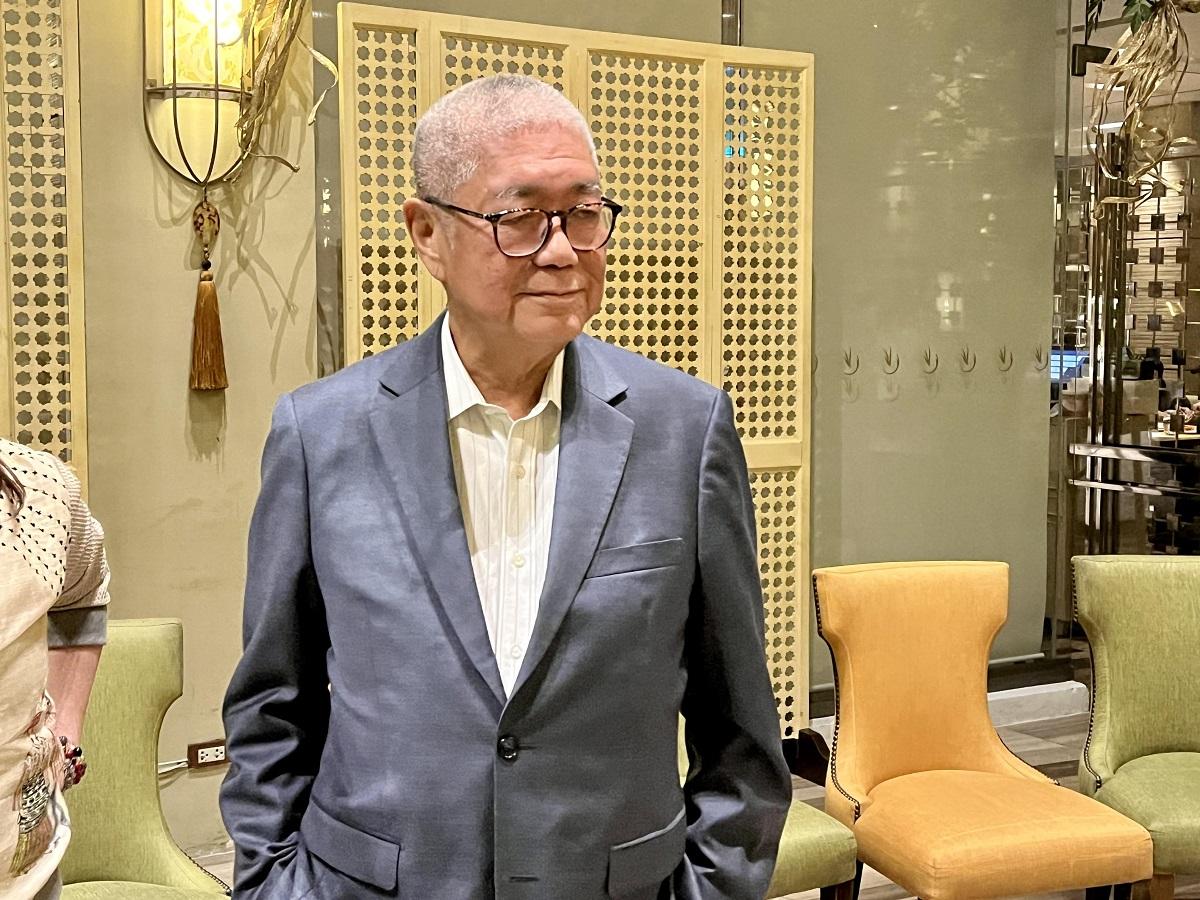

The Bangko Sentral ng Pilipinas’ (BSP) policy-setting Monetary Board is likely to consider cutting interest rates within the year if inflation rate falls to 4%, the central bank’s new governor, Eli Remolona, said.

In a chance interview with reporters Wednesday evening, Remolona said the 5.4% inflation rate in June “somewhat” supports the BSP’s “long pause” in adjusting interest rates.

Inflation, or the rate of increase in consumer goods and services prices, recorded its fifth straight month of deceleration last month from a peak of 8.7% in January.

“Yes, the data suggest that but you know the BSP is an inflation-targeting central bank. That means it’s structurally hawkish when it comes to inflation,” the BSP chief said.

Since May last year, the Monetary Board has raised interest rates by a total of 425 basis points to temper rising inflation.

Last month, monetary authorities held the BSP’s interest rates unchanged for the second straight meeting amid the continued inflation easing.

Asked if a rate cut is possible within this year if inflation falls to 4%, the upper end of the government’s target band of 2% to 4%, Remolona said, “Of course, we’ll consider it. The Monetary Board will consider it.”

For his part, BSP Deputy Governor for Monetary and Economics Sector Francisco Dakila Jr. said that inflation rate will likely fall below 4% come October.

As to the other factors that may trigger a rate cut, Remolona said the central bank will look into the country’s economic output as well as what its American counterpart, the US Federal Reserve, does as far as interest rates are concerned.

“We do it one meeting at a time. But in doing it one meeting at a time we’ll also look forward at what we might do down the road,” Remolona said.

EXPLAINER: Higher policy rates: How are you affected?

Monetary policy or interest rates are among the tools used by central banks to stabilize inflation through controlling money supply by raising borrowing costs.

For example, the BSP sets the overnight reverse repurchase rate or the key policy rate, in which the central bank borrows from banks to maintain price stability.

This, in turn, impacts the country’s money supply as it shifts money from banks into the central bank.

Tighter money supply could make consumers and businesses spend less, therefore reducing economic activity or lowering demand and eventually lowering prices. —KBK, GMA Integrated News