BIR assures online sellers it will be ‘reasonable’ on income declaration, no hefty fees

The Bureau of Internal Revenue (BIR) on Thursday assured online sellers that it will be reasonable in determining the appropriate taxes for the incomes declared after it required those conducting businesses through digital means to register with the taxman.

“BIR would like that all engaged in online selling be registered,” BIR Deputy Commissioner Arnel Guballa told GMA News Online.

The BIR released Revenue Memorandum Circular No. 60-2020, requiring “all persons doing business and earning income in any manner or form, specifically those who are into digital transactions through the use of any electronic platforms and media, and other digital means” to register their businesses on or before July 31.

The taxman, likewise, encouraged online sellers or those whose businesses are done through electronic or digital means to “voluntarily declare their past transactions.”

Past transactions will be subject to pertinent taxes.

Guballa said that on the declaration of past transactions, “BIR would be reasonable on that.”

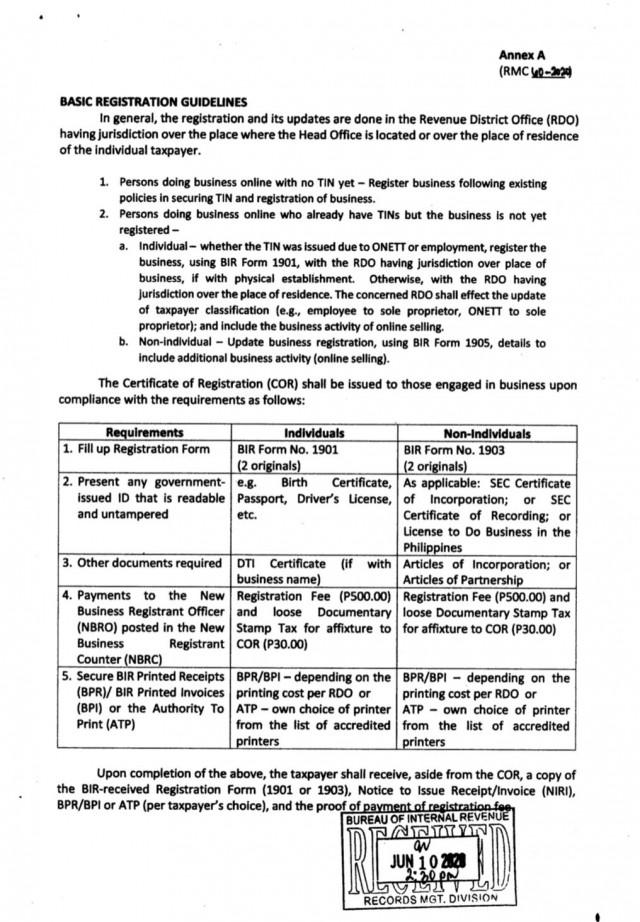

The BIR official also assured that there will be no hefty registration fees.

“The registration fee [is] P500, plus P30 documentary tax stamp,” Guballa said.

To avoid penalties, the BIR told online sellers to register and make their appropriate declarations not later than July 31.

Newly-registered business entities, including existing registrants, are also advised to comply with the following:

- Issuance of registered Sales Invoice or Official Receipt for every sale of goods or services to clients, customers, or buyers

- Keeping of registered Books of Accounts and other accounting records of business transactions

- Withholding of taxes, as applicable

- Filing of required tax returns

- Payments of correct taxes due on time

The basic registration guidelines are below:

Presidential spokesperson Harry Roque earlier said that those earning below P250,000 are exempted from paying income tax. This is pursuant to the Republic Act No. 1093 or the Tax Reform for Acceleration and Inclusion (TRAIN) law.—AOL, GMA News