Drilon wants to split CREATE into two bills; Pia Cayetano wants it intact

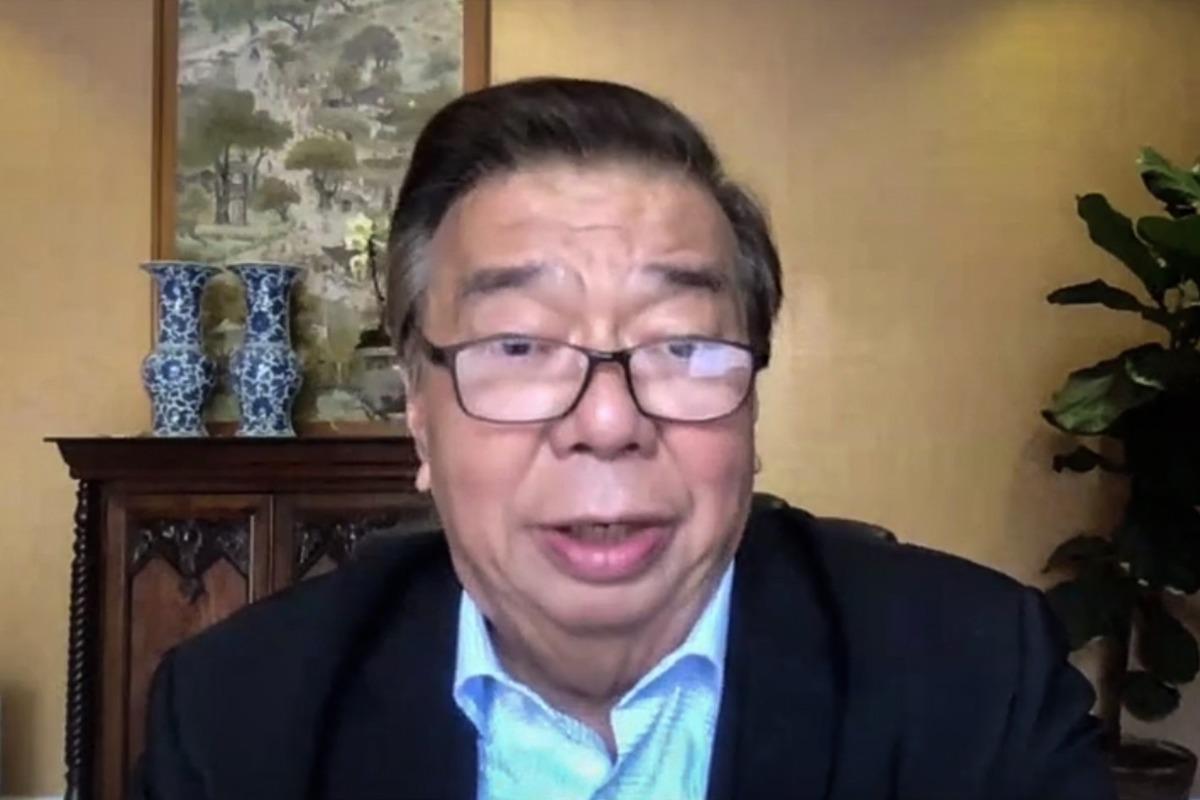

Senate Minority Leader Franklin Drilon on Wednesday proposed to split the corporate income tax reform bill into two because of an issue which he said may weaken the Congress as an institution, citing the provision on rationalizing incentives.

The Corporate Recovery and Tax Incentives for Enterprises (CREATE) bill seeks to reduce corporate income tax rate to 25% from the current 30% and at the same time rationalize the incentives that firms are receiving.

Interpellating Senate Ways and Means Committee Chairperson Pia Cayetano, Drilon said the bill cannot be fully recognized as a revenue measure because of its provision on rationalizing incentives.

"When you classify this measure as a revenue measure, then the President would have the power to exercise the line item veto over a matter, which is not strictly a revenue measure—and that is the other provisions in the rationalization of fiscal incentives which involves policies," Drilon said.

"I think it can be forcefully argued that the rationalization of the fiscal incentive should not be a revenue measure and therefore the authority of the President on the line-item veto should not be existing," he added.

Drilon said keeping the CREATE bill as it is could weaken the power of Congress as a co-equal branch of government because as a consequence, all bills that would have the slightest indication of having a "revenue aspect," even if it was just secondary, would give the President the power to do line-item vetoes.

Further, he said that Cayetano, the sponsor of the bill, should not worry because the chamber will still both discuss the lowering of the corporate income tax rate and the rationalization of incentives but on two separate measures.

Responding to the proposal to split the bill into two, Cayetano argued that the rationalization of incentives is directly related to revenues too.

"The rationalization of incentives is actually not alien to the subject matter of the corporate income tax. Because this addresses tax leakages and it is the reverse of increasing the tax, decreasing the tax," she said.

"In the early part of our interpellation, we emphasized the fact that this is foregone revenues. Thus, we need to rationalize because otherwise, these are tax revenues that are being exempted, not being collected, being given on a silver platter," she added.

Cayetano said her position was to keep the CREATE bill intact but added that she is open to discuss the matter in caucus with her colleagues.

The Senate will hold a caucus for CREATE at 1 p.m. on Thursday. The period of debates is expected to continue during session but they are also hoping that the period of amendments can start on the same day as they aim to pass the bill on final reading next week before Congress goes on break.

The CREATE bill is a tweaked version of the proposed Corporate Income Tax and Incentives Reform Act (CITIRA), a measure certified by the Palace as urgent. The lower house approved the counterpart bill last year. -- BAP, GMA News