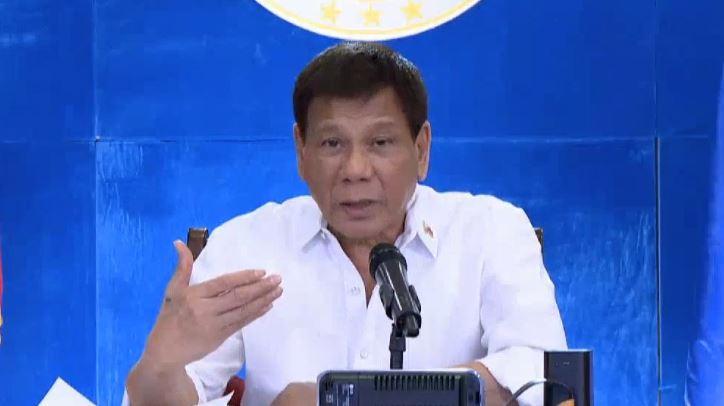

Duterte signs law 'strengthening' Anti-Money Laundering Act

President Rodrigo Duterte has signed into law Republic Act No. 11521 or the measure strengthening the country's 20-year-old Anti-Money Laundering Act.

A security and confidentiality clause was added to the 11-page law, requiring the Anti-Money Laundering Council (AMLC) and its secretariat to protect and keep confidential all information they receive or process, even after they leave the council.

Violators of the confidentiality clause will be imprisoned for three to eight years, and fined for P500,000 to P1 million.

The new law allows the Court of Appeals (CA) to issue a freeze order from 20 days to six months. The freeze order is deemed lifted if no case if filed against the person within the freeze period set by the appeals court.

Only the Supreme Court (SC) was authorized to issue a temporary restraining order or writ of injunction against any freeze order.

The new law also prevents any court from stopping the AMLC from conducting civil forfeiture proceedings to preserve or protect the assets in question, adding that only the SC or CA can do so.

The new law clarifies that the AMLC is prohibited from participating in the operations of the Bureau of Internal Revenue, and may only "coordinate" with the bureau regarding tax cases related to money laundering.

The AMLC was given up to 90 days to come up with Implementing Rules and Regulations. The law takes effect "immediately after the completion" of its publication in the Official Gazette or newspapers of general circulation.

The House of Representatives approved its version of the measure on third and final reading on December 1, while the Senate approved its own version on January 18. Then last week, the House of Representatives ratified the bicameral conference committee report on the measure.

The approved bicameral version had included tax crime as a predicate offense to money laundering and set a threshold to excess of P25 million.

The bicameral panel also agreed to require the submission of reports on all real estate transactions involving an excess of P7.5 million to the Anti-Money Laundering Council.

It also retained the House provision granting the AMLC the power to investigate, issue subpoenas and conduct search and seizure.

Moreover, the final version included Philippine offshore gaming operators or POGOs and their service providers among the covered persons.

The amendments are seen to help the country avoid being included in the “gray list” of the Financial Action Task Force (FATF)-International Cooperation Review Group.

The inclusion in the FATF’s gray list is said to result in an "additional layer" of scrutiny from regulators and financial institutions, delayed processing of transactions and blocking the country’s road to an “A” credit rating.

The gray-listing is also seen to prejudice the business sector and overseas Filipino workers.

The FATF had given the Philippine government until February 1 to enact and implement the changes to the AMLA, in accordance with its standards against money laundering and terrorist financing. The initial deadline was originally set in October 2020, but was extended due to the COVID-19 pandemic.

The Philippines was gray-listed by the FATF in 2000 for failing to address “dirty” money issues, paving the way for the enactment of RA 9160 in 2001. It was subsequently removed from the list in February 2005.

The FATF reportedly will decide in June instead of February 2021 whether or not the Philippines will be included in the watchdog’s gray list. -NB/MDM, GMA News