Pulse Asia: Controlling inflation remains Filipinos' top urgent concern

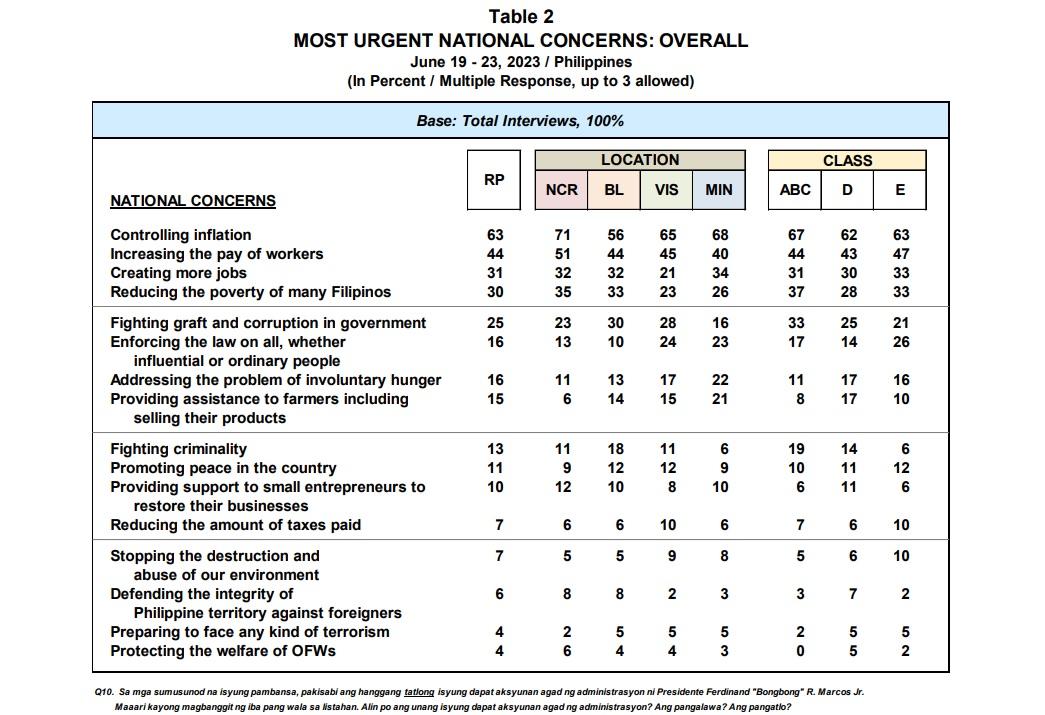

The need for the Marcos administration to control inflation remains the most urgent concern of Filipinos at 63%, a Pulse Asia poll showed.

The Pulse Asia survey, taken last June 19 to 23, 2023, showed that the 63% of Filipinos whose top concern is controlling inflation remained unchanged compared with the first quarter of the year.

Controlling inflation — the rate of increase in the prices of consumer goods and services — is also the top concern across all income classes, reaching 67% in class ABC, followed by 63% in Class E and 62% in Class D.

Ranking second is increasing workers’ pay at 44%, followed by creating more jobs (31%) and reducing poverty 30%, respectively.

At fifth is the need to fight graft and corruption at 25%.

The need to enforce the law on all, whether influential or ordinary people, and addressing the problem of involuntary hunger both got 16%.

Meanwhile, providing assistance to farmers, including selling their products, got 15%.

Other issues that Filipinos want addressed include fighting criminality (13%), promoting peace in the country (11%), government helping small businesses and entrepreneurs (10%), reducing the amount of taxes paid by citizens (7%), stopping environmental degradation (7%), defending national territorial integrity (6%), and dealing with terroristic threats and protecting the welfare of overseas Filipino workers (both at 4%).

There was, however, a 7-percentage points increase in the number of Filipinos who are concerned about enforcing the rule of law at 16% in June as against the 9% in the last quarter.

Pulse Asia’s survey is based on a sample of 1,200 representative adults 18 years old and above. It has a ± 2.8% error margin at the 95% confidence level.

"Subnational estimates for the geographic areas covered in the survey have the following error margins at 95% confidence level: ± 5.7% for Metro Manila, the rest of Luzon, Visayas, and Mindanao," Pulse Asia Research, Inc. said.

The Pulse Asia poll was done amid the Senate hearings regarding the operations of the National Grid Corporation of the Philippines (NGCP) to determine whether it has violated any of the provision of its franchise, the resignation of the Vice President Sara Duterte as a member of the Lakas-Christian Muslim Democrats (Lakas-CMD) party, the demotion of Senior Deputy Speaker Gloria Macapagal-Arroyo to the post of Deputy Speaker over her reported involvement in a plot to unseat incumbent House Speaker Martin Romualdez, among others.

Inflation

The Philippines’ inflation rate slowed for a fifth month in a row in June on the back of slower movements in food, transport, and utility prices, the Philippine Statistics Authority reported on Wednesday.

National Statistician and PSA chief Claire Dennis Mapa reported that inflation eased to 5.4% last month from 6.1% in May, bringing the year-to-date rate to 7.2%.

This is the fifth time that inflation slipped from a peak of 8.7% in January.

President Ferdinand "Bongbong" Marcos Jr. on Wednesday said his administration will continue to try to keep the country's inflation rate down as he looks at "increased production" as the key to reaching this goal.

However, while inflation has decelerated for the past five months, consumer prices are expected to continue climbing faster than the government’s target range and longer than previously recorded.

This was according to former Bangko Sentral ng Pilipinas (BSP) governor Felipe Medalla, as he cited the need for a discussion on a whole-of-government approach to address local supply shocks.

Medalla said they forecast that it may take a few more months — in October, particularly — before inflation can fall below the 4% inflation target.

“In the past, marami na ‘yung 15 months straight na above target… Sa forecast namin, baka October pa bago mag-below 4 (percent) which means 18 straight, consecutive months dire-diretso na mas mataas kaysa 4% na ating target ‘yung inflation,” he added.

(In the past, 15 straight months above the target was already a lot. Based on our forecast, inflation could only slow to within the target range by October which means 18 straight, consecutive months that inflation would be above our 4% target.)

The BSP is expecting inflation to decelerate to the target range of 2% to 4% by October. If realized, this would bring inflation above the target range for 18 straight months, beating the previous record of 15 consecutive months. —KG, GMA Integrated News