Part 2 of a 3-part series

As one of the country’s largest gold and copper producers, Philex Mining Corp. has often prided itself as a “responsible miner” that takes its environmental duties seriously. But its reluctance to pay the hefty fine for the Padcal mine spill last August in Itogon, Benguet – the biggest mining disaster in the country – has cast doubts on its pledge to clean up its waste and confront the risks that mining companies face in this hazard-prone country. The Mines and Geosciences Bureau (MGB) had ordered the mining firm to pay P1.034 billion in fines last September 26, about a month after the tailings pond of Philex was breached, leaking around 20 million metric tons of mine wastes into water channels. Philex balked at the stiff penalty, saying that payment of the fine would be an admission of negligence. Instead, the company attributed the leakage to force majeure resulting from unusually heavy rainfall on the day the spill occurred, and proposed a clean-up compensation package as an alternative. “As a responsible mining company, it is fully committed to compensating affected parties, remediating and cleaning up the effects of the spill, and adopting monitoring and decommissioning strategies for the affected areas and so, reaffirms in closing, its willingness to pay P1,034,358,971.00 assessment to fund those purposes,” the mining company said in a motion for reconsideration to MGB dated December 3. On Thursday,

Philex finally decided to pay the fine after the MGB rejected the company's appeal for the waiver of the penalty with finality last January 15.

Insurance claims Philex Mining’s spokesperson Mike Toledo maintains that the incident was not the fault of the company, which is fully capable of forking out the amount. “Accidents do happen. How a company reacts to an accident is the real measure of responsibility. At our end, the accident was not hidden to the public. We assume responsibility,” he asserts. “We will not run away. We will not hide. We, as it stands, are willing to pay the amount being quoted [provided that it will be] used in clean-up measures and rehab efforts,” Toledo added. In a press conference last August, Philex Mining’s chief executive officer Manny Pangilinan said the company’s lone operating mine in Padcal took out $50 million (P2.5 billion) in environmental insurance and another $30 million (P1.2 billion) in business interruption insurance, according to published reports. In addition, the Hong Kong-based investment management firm First Pacific Co. Limited has agreed to extend an aggregated facility of $200 million that includes a P2.1 billion loan to Philex for the clean-up and rehabilitation of the Padcal Mine. The penalty for Padcal represents about one-third of Philex’s environmental expenses since the mine started its operations, which has totaled P3.31 billion so far.

A responsible miner pays fines It is also the largest mining fine ever imposed by MGB, its Director Leo Jasareno told GMA News Online. In a report entitled “Sustainable Development in the Philippine Mineral Industry: A Baseline Study,” the MGB said it has only collected P37.5 million – or less than four percent of Philex’s penalty – in mine wastes and tailings fees from 1981 to 2000. Erring companies are charged P50 per metric ton of leaked tailings in fees, which accounts for the huge penalty levied on Philex. Jasareno says the refusal of Philex to pay the fine casts doubt on its claim as a responsible miner, and betrays its lack of foresight in dealing with changing weather patterns. “The Philippines is now facing a new normal in weather and climatic disturbances. This has become public knowledge and, therefore, PMC should have already prepared the appropriate contingency measures,” he said in a letter to the company in November. “If Philex is a responsible miner, it will depend on their character in dealing with the incident. So far, they have not met our expectations kasi kinukwestyon nila ‘yung ating pagpapabayad e,” Jasareno said in a separate interview. “[If] they are sincere in helping out morally, dapat bayaran nila ang penalty. I don’t think it is moral [na] just because of legality hindi ka magbabayad kahit man lang piso,” he added. The P1.034 billion penalty shall be remitted to the National Treasury and accrue to the Mine Wastes and Tailings Reserve Fund, which will be used for the settlement of damage claims from affected communities, Jasareno explained. Meanwhile, Philex has a separate pending case with the Pollution Adjudication Board, also under the Department of Environment and Natural Resources, over alleged violation of the Clean Water Act. Philex Mining faces a daily penalty of P50,000 to P200,000 while the tailings are still in Balog Creek and Agno River. Philex started its clean-up last August when the weather improved.

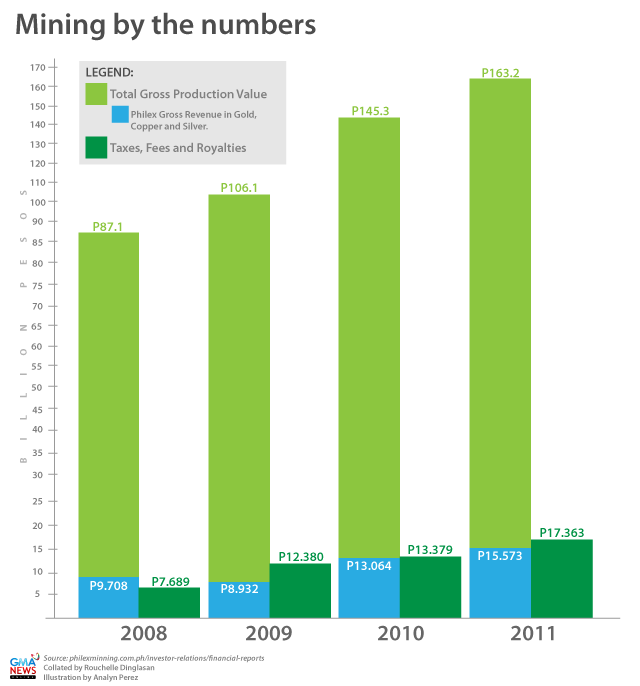

Economic impact Since the major leak on August 1 and minor spills in succeeding weeks, Philex Mining has suspended its operations in Padcal and remains shut until now, resulting in

losses of P30 million to P40 million daily, according to Eduardo Aratas, Padcal Mine spokesperson. In

addition, the mining firm needs to pay at least P200 million monthly for site maintenance. Philex has two other mine sites, the Silangan project in Surigao del Norte and Sibutad Project in Zamboanga del Norte, which are both in the exploration stage. Its Bulawan Project in Negros Occidental was decommissioned in 2002, according to the

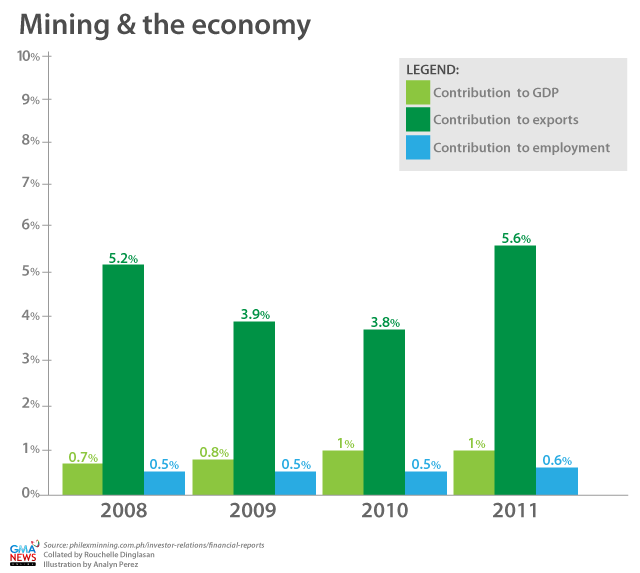

Philex website. The temporary closure of the Padcal mines has taken its toll on the economy, as the country’s metallic mineral production value dropped by 18.85 percent in the third quarter of 2012 to P79.52 billion compared to the same period in 2011, the MGB reported in December. According to the bureau, the lackluster performance of the mining industry was due to the suspension of Philex’s Padcal Mine and three other mining firms: Nonoc Nickel Project of Shuley Mines Inc. - Pacific Nickel Philippines Inc. in Surigao Del Norte, which has unsettled obligations with the government; Leyte Magnetite Sand Project of Leyte Irons and Corporation in Leyte Province, which leaked mine wastes to Lake Bito; and the Paracale Gold Project of Johson Gold Mining Corporation in Camarines Norte, which needs to repair its facility including its wastes pond. From January to June last year, Philex Mining was the second largest gold producer in the country with about P4 billion worth of gold output, more than a quarter of the entire national output, according to the MGB. Philex also produced P3.27 billion worth of copper, or about one third of the total national production, for the first half of 2012. Moreover, the Padcal mine was the fifth largest silver producer during the first half of the year, its output worth P75.5 million. According to Philex Mining’s annual report in 2011, Padcal Mine still has a total of 2.2 million ounces of gold mineral reserves worth about $3.7 billion, and 760 million pounds of copper. It employs 2,126 people and covers 13,729 hectares within the municipalities of Itogon and Tuba in Benguet. “Sa P100 million na budget [ng Tuba], 20 percent galing sa Philex at P79 million mula sa internal revenue allotment,” Tuba Mayor Florencio Bentrez said in a telephone interview. In Itogon, Mayor Oscar Camantiles was quoted by an independent fact-finding mission as saying that

Philex has a P1-billion tax deficiency since 2002. According to the mission report, “The company has refused to pay the municipality citing the settlement of boundary disputes between the municipalities of Itogon and Tuba as a requisite for payment of taxes.” In response, Philex spokesperson Toledo said the tax payment remains in an escrow account until the disputes are settled. Despite the negative impact on the economy, the Padcal mine will remain closed until Philex pays the P1-B penalty and makes sure its damaged tailings pond has been rehabilitated, Jasareno said. The lease for the Padcal mine, which was granted in 1958, is set to expire in 2020. But because of the temporary closure, the MGB may decide to extend its permit. “Hahaba ang mine life niya kasi suspended siya e. Hindi ka nagmimina, hindi nababawasan ang reserve mo,” Jasareno explained.

Mining reform The government’s experience with Philex has prompted the review and imposition of stricter measures to ensure that mining companies pay their dues fairly. “Nakita namin na may mga areas where policy did not cover… For instance, three months na pero hindi pa namin napapabayad ang Philex, bakit ang tagal di ba? There must be a way na ‘pag may incident na ganyan, bayad na agad,” Jasareno noted in the interview last November. President Benigno Aquino III also cited environmental concerns as one of the reasons why he wanted to increase the taxes on mining firms, as embodied in the latest directive on mining, Executive Order No. 79, which was signed on July 6 last year. “In terms of revenues, our position is government gets something like less than 10 percent of what they make but… for instance, one of the oldest firms, mining firms in the country, suffered multiple failures of their tailings pond and that redounds to quite a significant impact on the environment,” he said in a speech to members of the Foreign Correspondents Association of the Philippines last October. Although he did not mention the 57-year-old Philex Mining Corporation, it is the only mining firm that recently experienced a tailings leakage. –

YA, GMA News In Part 3: Mine spills are nothing new for Philex Read part 1 here: Fishers and gold panners become 'bakal boys' after Philex mine spill