How much do the presidentiable candidates owe?

Six presidential candidates have presented themselves to be scrutinized, weighed, praised or criticized based on all kinds of information that mostly have become public interest.

These include, of course, the Statement of Assets, Liabilities and Net Worth or the SALN. Having all served in government, all the candidates have filed these disclosures.

Former senator Rene Saguisag, the co-author of the law that mandated the filing of SALNs, cannot emphasize enough the value of SALN disclosures.

Transparency, transparency, transparency. That is the goal, he said.

“Ang intention namin dyan ni Uncle Jovy (Jovito Salonga,) and other co-authors… pag nilagay mo roon ang mga property mo, stock sa X company, makikita ng publiko kung may possible conflict of interest,” said the former senator.

The issue of conflict of interest usually attaches to the disclosures of properties, assets and business interests.

However, as the disclosures would show, equally important to what they own is what they owe — and to whom they owe.

As Saguisag noted, “Kaya yun eh statement of assets, liabilities, networth, business interest…Ang utang, dahil that will show kung bakit papaboran mo yung taipan na ganito. Eh yun pala eh me atraso ka dun.”

GMA News Research reviewed the declared liabilities of all the presidential candidates in their SALNs.

The liabilities include personal loans, stock subscriptions and income tax payables among others.

These payables vary in kind and ranges from a few thousand to multi-millions - one candidate had a relatively small automobile loan worth P78,560, and another, a massive P70 million-worth of personal loans

All the candidates declared at least one personal loan from an institution, a family member or a friend.

Owing a Makati bidder

For four years, Vice President Binay declared among his liabilities unpaid millions to a company that was a consistent bidder for security services for the Makati government.

The SALN of the Vice President showed that from 2011 up to his most recent filing for 2014, his liabilities include an “unpaid portion on the lease-to-own vehicle.”

Vican Security Services Corporation is listed as creditor.

Also from 2011, Binay added in his declared assets a Toyota Land Cruiser worth P9.6 million. He noted that this is “subject to a lease-to-own contract”.

From an unpaid balance of P6.88 million in 2011, the liability was down to P5.68 million in 2014. The amounts indicate a payment of around P600,000 every year except for the last year, 2014, when the balance did not change.

Vican Security Services Corporation was one of the four constant bidders in Makati City in 2013 and 2014 when Jejomar Erwin Binay, the VP’s son, was mayor.

Vican’s incorporator and president, Jonas Vinarao, contributed to the 2010 vice presidential campaign of Binay. The VP’s Statement of Election Contributions and Expenditures states that Vinarao donated P20,000.

In a reply sent to GMA News, UNA communications director Joey Salgado said, “The contract with Vican Securities is an arm’s length transaction duly reported in the SALN of the Vice President.”

An arm’s length transaction means a transaction between an independent seller and buyer.

Based on the bid documents, Vican bid for 13 security contracts worth P157.04 million in those two years. It did not win the bidding in any of these contracts.

The Vice President also declared in 2014 a personal loan worth P10 million from a certain Grace Mercado.

“Grace Mercado is a relative of the Vice President, and the loan granted by the former to the latter was used in, among others, the expenses the Vice President incurred and will continue to incur in holding the people behind the black propaganda against him liable in the court of law (example: litigation fees),” said Salgado.

Binay had total liabilities of P16 million in 2014. He declared an income tax payable worth P370,453 to the Bureau of Internal Revenue.

Binay and his wife Elenita, who had served one term as mayor of Makat City, had consistently declared income tax payables since their 1989 SALNs.

Big loans, little info

All presidential candidates had declared liabilities from private individuals or companies, and much is to be desired in terms of the quality of disclosure.

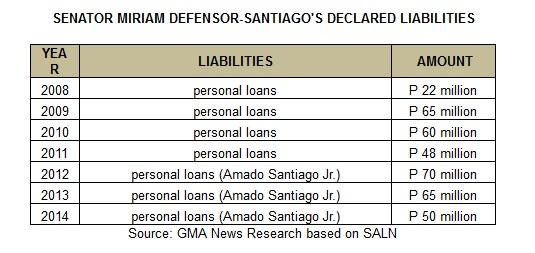

Sen. Santiago has been disclosing personal loans since her 2008 SALN, but only started naming her creditor in her 2012 declaration.

The senator has declared only one liability since her 2008 SALN – a personal loan which has ranged from P22 million to P70 million.

In her latest SALN for 2014, the senator declared a personal loan of P50 million. Her total asset was P 123.03 million and her declared net worth was P73.03 million.

From 2012 to 2014, she has named the creditor as Amado Santiago Jr.

Amado is the first cousin of Miriam’s husband, Narciso, according to a 1999 news article posted in the website of the senator.

GMA News Research had sought comment from the senator but has received no reply as of posting time.

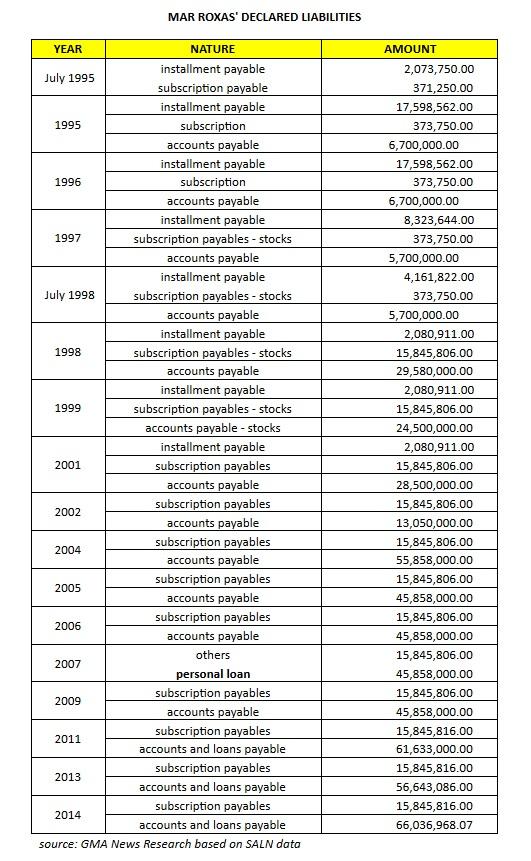

Former DILG secretary Mar Roxas, while detailed in the declaration of his assets, is less specific in his disclosures on the money he owes.

In most of his SALNs, Roxas categorized his liabilities as "accounts and loans payable," "subscriptions payable," or "installment payable."

In his 2014 SALN, he declared a total liability of P81.88 million - a subscriptions payable of P15.85 million and an accounts and loans payable of P66.04 million. Roxas did not name his creditor.

When asked about the details of his liabilities in a brief interview, Roxas said, “… mga utang ko yan, inutang ko sa pamilya ko yan, at yan naman ay malinis na pera.”

Owing a friend

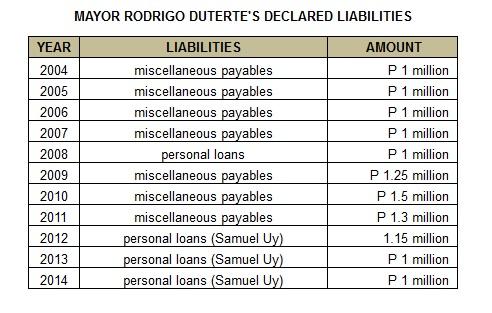

Similarly, Duterte also failed to name the creditor of “miscellaneous payables” and “personal loans” with amounts ranging from P1 million to P1.3 million in his 2004 to 2011 SALNs.

It was only in the 2012 SALN when Duterte named a creditor — a certain Samuel Uy. As of his last filed SALN in 2014, Duterte owed Samuel Uy a million pesos.

In a reply to a query sent by GMA News Research, Duterte explained,“The miscellaneous payables were actually various personal loans I obtained from Mr. Samuel Uy. Due to the passage of time, I could no longer recall with certainty the specific details of said accounts.”

The mayor wrote, “Whenever I am in need of immediate cash for my personal use and for some other purposes, Mr. Uy had never refused my pleas. From the time I started my political career, Mr. Uy has been a consistent contributor to my cause.”

“Mr. Samuel Uy is an old family friend who has been with me through thick and thin. Our friendship started when we were still young,” Duterte added. “ He comes from a wealthy Filipino-Chinese family in Davao City, who had established a long line of businesses including distribution of household appliances, furnitures, office equipment, motorcycles and construction materials; leasing of real estates; and poultry farm, among others.”

The mayor’s reply identified as well other businesses of Uy including a motel, hotel a gasoline station and realty businesses, and a majority ownership of a private hospital in Davao City.

Family creditors

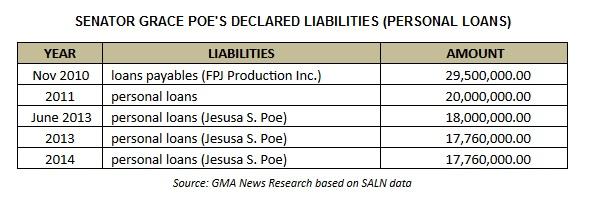

Senator Grace Poe’s declared creditors are closer to home.

In November 2010, filing her first SALN as chair of the Movies and Television Review and Classification Board (MTRCB), Poe declared a loan worth P29.5 million payable to FPJ Production Inc.

The SEC did not have available records of the financial statements of FPJ Production Inc. for 2010 when Sen. Poe declared the loan. FPJ Productions have financial statements only for the years 1995 to 2003, 2005, 2012, and 2013.

Based on the records filed at the SEC, Poe was the vice president of the company in 2008, 2012 and 2013. She held 119 of 500 shares of the company, or 23.8%, in the same years.

In her first SALN in 2013 as an elected Senator, Poe disclosed an P18 million personal loan from her mother.

“Ang mom ko, tumulong dahil nung kami'y lumipat dito, yung iba para sa construction cost ng bahay galing na rin sa kanya yun. Unti-unting binabayaran,” Poe said in an interview with GMA News.

As of Poe’s 2014 SALN, her loan to her mother had decreased to P 17.76 million.

The senator has been forthcoming about other monies she owed: stock subscription balance payable to JSP Realty and Development Corporation, and 226 Wilson Development Corp worth P 7.5 million each.

Based on the latest 2014 general information sheets of the companies, Poe and Roces are stockholders and officers of both businesses.

Poe owns 9.48 percent of JSP Realty, and 15.94 percent of 226 Wilson. Her mother holds the largest chunk of ownership for both companies, owning 81.04 percent and 74.89 percent, respectively.

The senator also declared a liability of stock subscription balance payable to Chambrant L. Holdings Corp, where her husband Teodoro Misael Daniel Llamanzares is the corporate secretary and holds 20 percent of its stocks.

Poe has an automobile loan payable worth P2.64 million and lot installment payable worth P 1.9 million in her latest 2014 SALN. Her total declared liability is P37.49 million that year.

Personal loans vs. institutional loans

Between personal loans and institutional loans, the latter customarily has more paper trail.

Eric Magpale, a member of the Philippine Institute of Certified Public Accountants (PICPA), said, “Pag institutional loan kasi, that’s very easy to verify... For example, that’s the business of a bank. Hindi mo naman pwedeng i-haggle sa bank na like this and like that because they follow certain standards.”

In contrast, there is more room for negotiations in personal loans or “related party loan agreements,” Magcale said, noting that this does not make it irregular nor illegal.

What’s important, he said, is the terms of reference or the terms of the loan agreement. This document details the obligations of both parties, the borrower and the creditor.

In the interest of transparency, Magcale noted that the SALN submissions should include these documents whenever a loan or a liability is declared.

While all the presidential candidates had declared various liabilities and loans in their SALNs, no one had attached any document pertaining to loan agreements.

Magcale notes that identifying the creditor actually draws attention to that person or entity that provided the loan. Does the person or entity have the capacity to give that kind of loan? Not to mention catching the interest of the taxman.

“The impact [on the creditor] is, there is interest income earned. Taxable sa part ni creditor,” Magcale said.

It is important to note, the accountant says, that while a loan is clearly a liability, a minus in the balance sheet, it as a plus on the other side as well.

“If there is a corresponding increase in your liability, technically, it’s reasonable to assume that there should also be a corresponding increase in your asset,” said Magcale.

Simply, you borrow to pay for, or acquire, something. –with reports from Ivan Mayrina, Steve Dailisan, Mariz Umali/FTB, GMA News Research/JST, GMA News