Inflation to breach government target band in 2021, BSP concedes

The consumer price index is expected to grow faster than the government's target band this year due to the continuous supply-side issues, the Bangko Sentral ng Pilipinas (BSP) conceded.

Following a monetary policy meeting on Thursday, the central bank said it now expects inflation to average 4.2% this year from its earlier forecast of 4.0%, breaching the target range of 2% to 4%.

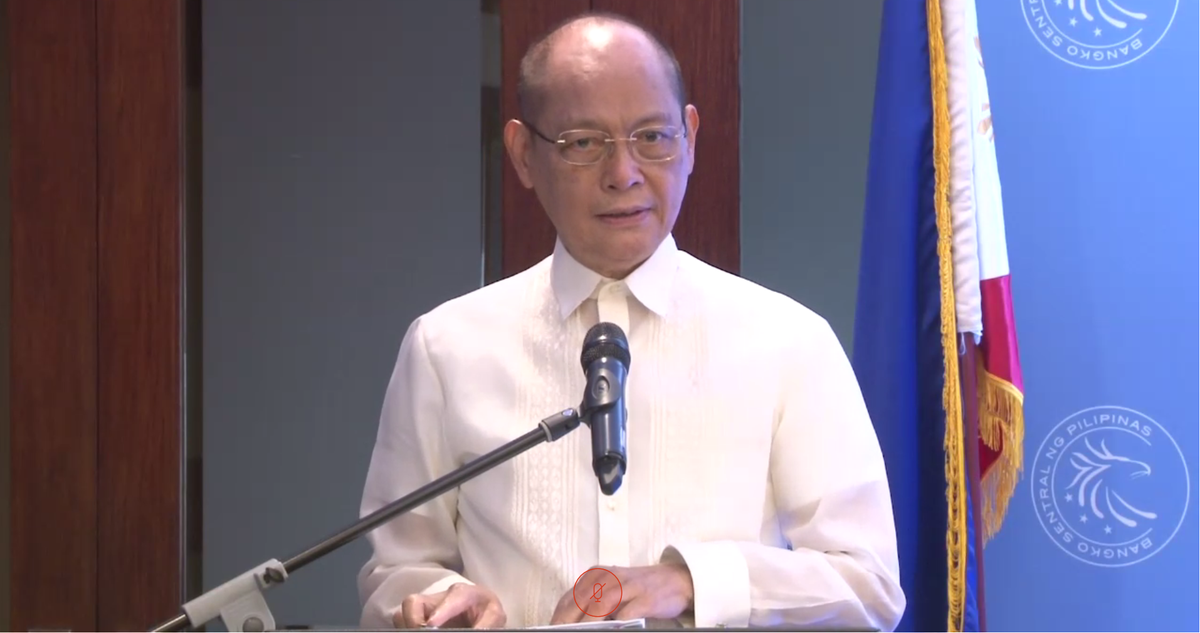

"Inflation may breach the upper end of the target range of 2-4% in 2021, reflecting the impact of supply-side constraints on domestic prices of key food commodities such as meat as well as the continuing uptick in international oil prices," BSP Governor Benjamin Diokno said in a virtual briefing.

The central bank said the higher forecast takes into consideration the elevated outturn in February when inflation clocked in at 4.7%, the fastest since January 2019's 4.4%.

Latest inflation forecasts of the @BangkoSentral:

— Jon Viktor Cabuenas (@ViktorCabuenas) March 25, 2021

2021: 4.2% (versus 4.0% previously)

2022: 2.8% (versus 2.7% previously)

Upward revisions factor in the elevated inflation outturn in February, and the outlook on international oil prices. pic.twitter.com/xHDm5XmA1s

The government blamed the higher inflation print on the increase in prices of pork which grew 20.7% in the month, versus 17.1% in January. A price ceiling has since been set in efforts to arrest rising prices.

As part of its mandate, the BSP maintains price stability conducive to a balanced and sustainable growth of the economy and employment. It also promotes and maintains the stability and convertibility of the peso.

The BSP on Thursday also revised upward its 2022 inflation outlook to 2.8% from its earlier forecast of 2.7%, taking into consideration international oil prices.

"Tighter domestic supply of meat products and improved global economic activity could lend further upside pressures on inflation," Diokno said.

"However, the ongoing pandemic also continues to pose downside risks to the inflation outlook, as the recent surge in virus infections and challenges over mass vaccination programs continue to temper prospects for domestic demand," he added.

In the same briefing, BSP Deputy Governor Francisco Dakila Jr. said that the inflation continues to transitory, and will thus not be a trigger to exit from an accommodative policy stance.

The Monetary Board on Thursday decided to keep policy rates at record lows -- the overnight reverse repurchase facility at 2.00%, overnight deposit at 1.5%, and overnight lending facility at 2.5%.

The Monetary Board of the @BangkoSentral on Thursday decided to keep policy rates at record lows -- the overnight reverse repurchase facility at 2.00%, overnight deposit at 1.5%, and overnight lending facility at 2.5%. pic.twitter.com/PEMZf9Fdxl

— Jon Viktor Cabuenas (@ViktorCabuenas) March 25, 2021

Policy rates were slashed by 200 basis points in 2020 -- 25 basis points in February; 50 basis points each in March, April, and June; and another 25 basis points in November.

Diokno on Wednesday said it is still too early for the central bank to start its COVID-19 exit strategy, as the timing will largely depend on economic data.—LDF, GMA News